Global Financial Diplomacy in Flux: The High-Stakes Battle Between Economic Sovereignty and Strategic Support

- Unprecedented financial maneuvers reveal deepening geopolitical tensions between EU members and global powers

概览

The global economic landscape is experiencing a profound recalibration, marked by two simultaneous strategic experiments that challenge traditional financial boundaries. China's $113 billion Hainan Free Trade Port and the European Union's controversial plan to leverage frozen Russian assets represent more than isolated policy initiatives—they signal a fundamental reshaping of international economic engagement.

In China's strategic move, the Hainan experiment represents a calculated risk to reposition the country's economic model. By creating a duty-free zone with at least 30% local value-added requirements, Beijing is attempting to attract foreign investment while maintaining controlled market access. This approach reflects a nuanced response to U.S. trade tensions, offering a managed liberalization that could potentially serve as a blueprint for broader economic reforms.

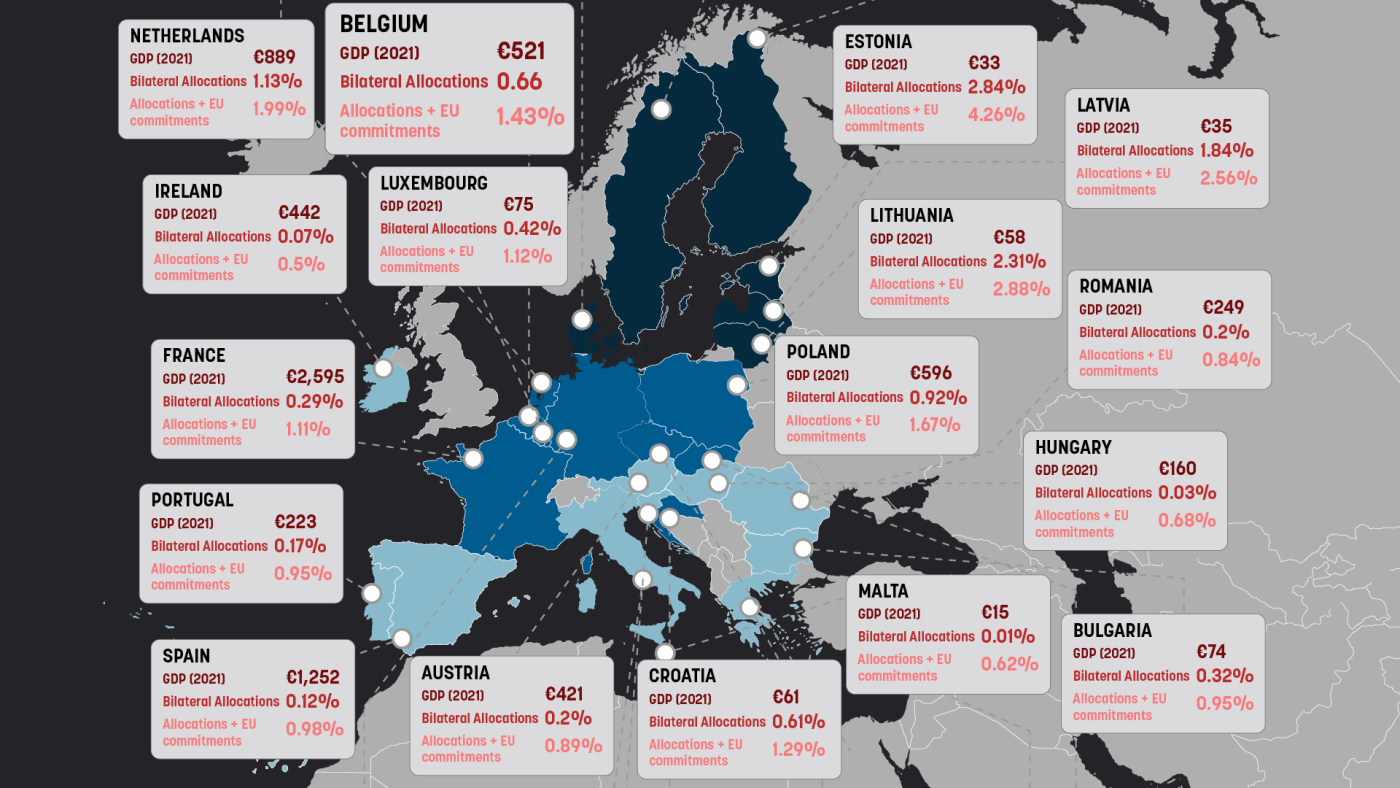

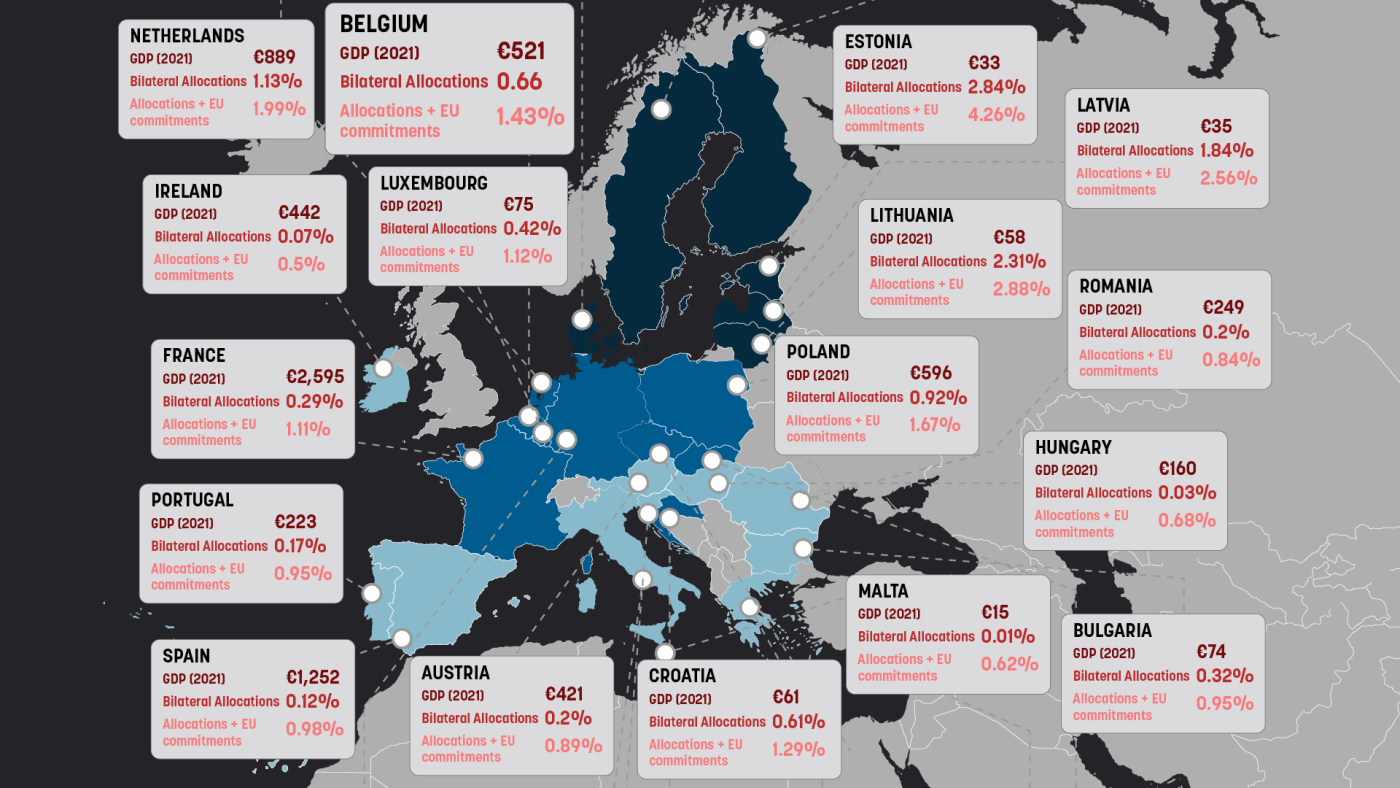

Simultaneously, the EU is navigating an equally complex diplomatic minefield with its unprecedented proposal to use frozen Russian central bank assets to support Ukraine. The €210 billion initiative exposes deep fractures within European diplomatic circles. Hungary's Viktor Orbán has labeled the plan a "dead end", while other members like Belgium express significant legal reservations. The proposed mechanism—which would provide uncapped guarantees to member states against potential Russian legal challenges—represents a novel approach to conflict financing that could set future precedents for international asset utilization.

These developments share a critical characteristic: they represent strategic financial engineering designed to create new economic opportunities while managing geopolitical risks. China's Hainan model seeks to attract international business through controlled liberalization, while the EU's Russian asset strategy aims to support Ukraine without triggering broader economic conflicts.

The underlying tension in both scenarios revolves around balancing economic sovereignty with strategic objectives. For China, this means creating a controlled environment for international engagement. For the EU, it involves finding innovative financial mechanisms to support Ukraine without direct confrontation with Russia.

Critically, both initiatives are experimental—their success is far from guaranteed. Trade negotiators remain skeptical about Hainan's ability to rival Hong Kong, just as EU diplomats are divided on the Russian asset proposal. These are calculated risks that reflect the complex, multipolar economic landscape of the 2020s.