BP's Strategic Reboot: How Meg O'Neill's Appointment Signals a High-Stakes Energy Transformation

- Navigating Corporate Survival in a Volatile Global Energy Landscape

概览

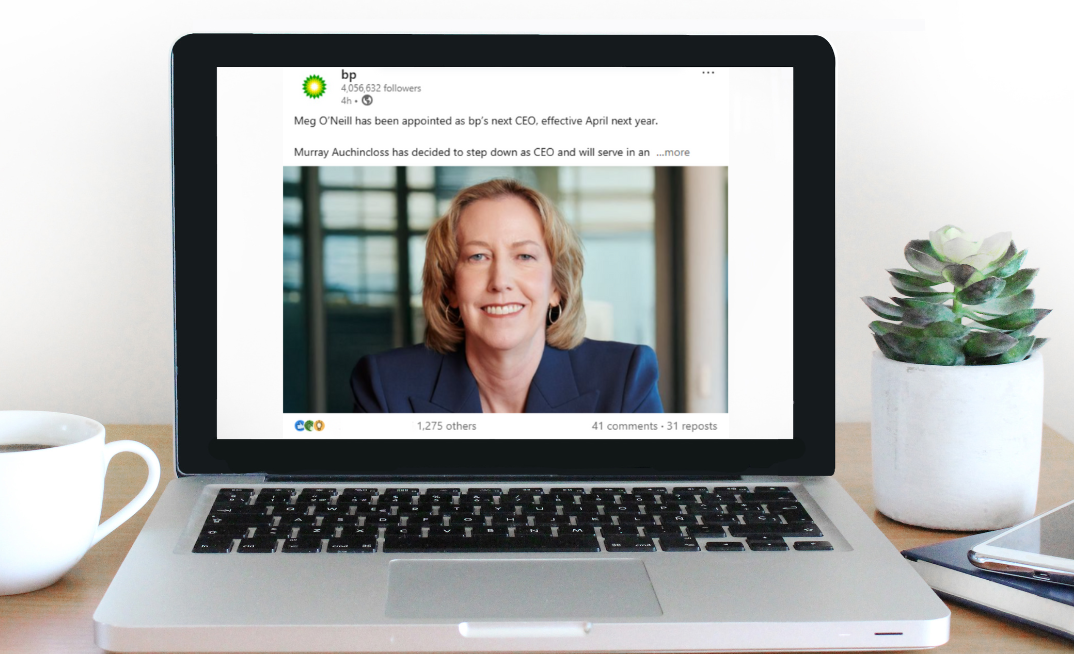

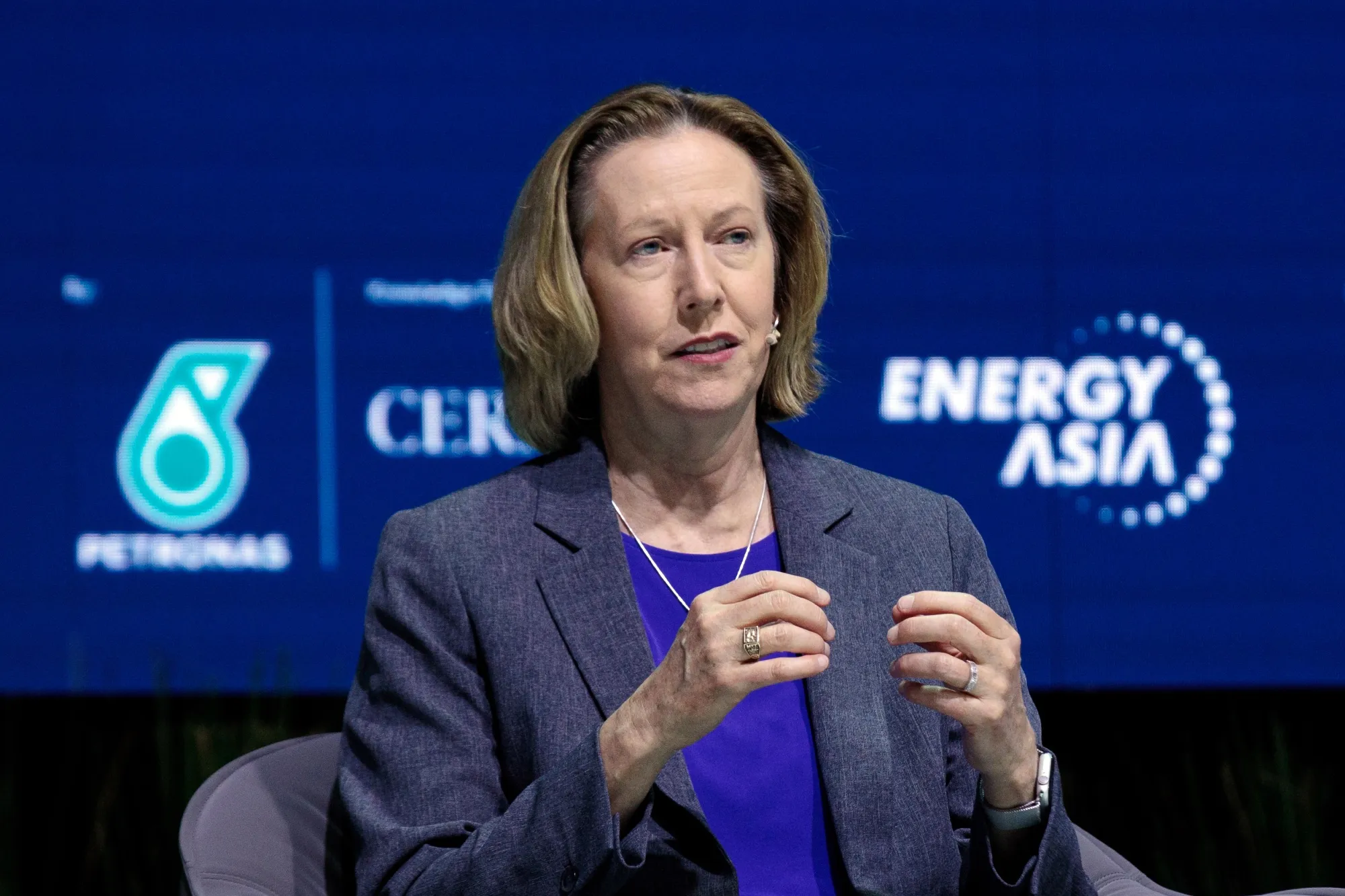

BP stands at a critical inflection point, with its latest CEO transition revealing far more than a simple leadership change. The appointment of Meg O'Neill marks a deliberate strategic recalibration that reflects the complex challenges facing global energy companies in an era of unprecedented market volatility.

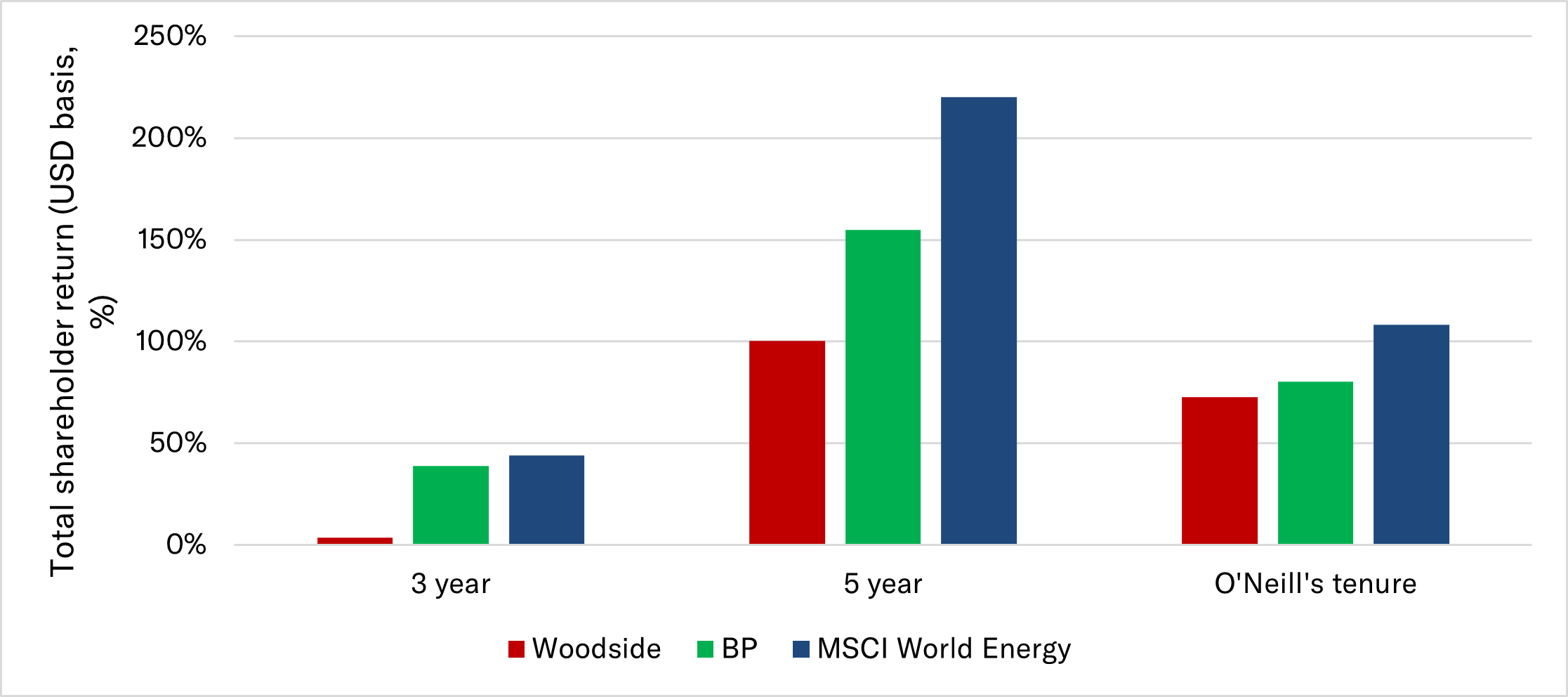

Strategic Pivot and Performance Pressure are the core dynamics driving this leadership transformation. After years of strategic uncertainty—oscillating between renewable ambitions and traditional oil operations—BP is signaling a decisive return to its core competencies. O'Neill's background, with 23 years at Exxon Mobil and a successful tenure at Woodside Energy, suggests a laser-focused approach to upstream oil and gas production. The company's ambitious target of producing 2.3-2.5 million barrels of oil equivalent per day by 2030, coupled with a $4-5 billion cost-cutting initiative, demonstrates a ruthless commitment to operational efficiency.

The leadership transition also reveals the intense shareholder-driven dynamics reshaping corporate strategy. Activist investors like Elliott Investment Management have clearly pushed for more decisive management, forcing BP to prioritize shareholder value over experimental green energy strategies. This signals a broader industry trend where traditional energy companies are being compelled to demonstrate immediate financial performance rather than long-term transformational promises.

Merger and Acquisition Undercurrents add another layer of complexity to BP's strategic repositioning. The company's improved performance paradoxically makes it an attractive acquisition target for larger rivals like Shell, Exxon Mobil, and Chevron. O'Neill's appointment might be a preemptive move to either fortify BP's independence or strategically position it for a potential high-value merger.

The rapid CEO turnover—four leaders in six years—underscores the immense strategic challenges facing major energy companies. Global energy transitions, technological disruptions, and evolving market dynamics demand unprecedented agility and strategic clarity. O'Neill's selection as the first external and first female CEO in BP's century-long history symbolizes a radical break from traditional corporate succession models.

Investors have responded positively, with BP's share price showing resilience and potential. The market sees O'Neill's appointment not just as a leadership change, but as a strategic recalibration that could redefine BP's competitive positioning in a complex global energy ecosystem.