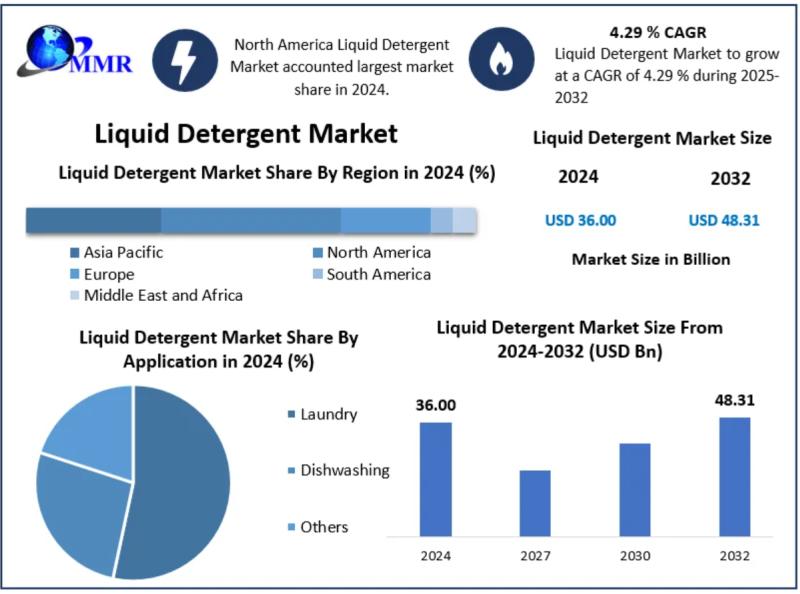

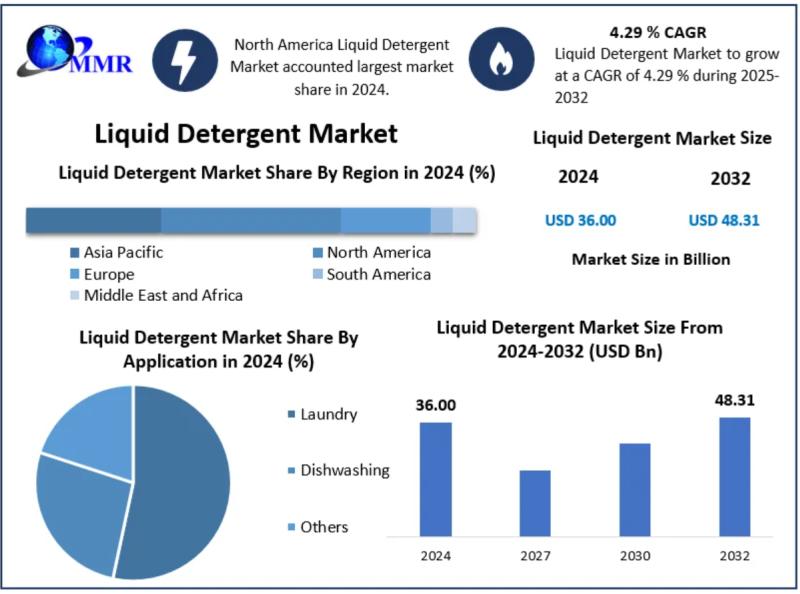

Liquid Detergent E-Commerce Boom | $48.3B Market Opportunity for Cross-Border Sellers

- Global market expanding 4.29% CAGR to $48.31B by 2032; Asia Pacific fastest-growing region; e-commerce channels outpacing retail; private-label and eco-friendly formats driving seller opportunities

概览

The global liquid detergent market presents a $12.31 billion growth opportunity for cross-border e-commerce sellers between 2024-2032, expanding from USD 36.00 billion to USD 48.31 billion at a 4.29% compound annual growth rate. This represents a critical inflection point where e-commerce channels are experiencing faster growth than traditional retail, creating immediate opportunities for sellers to capture market share in both established and emerging regions.

Market Dynamics Favor E-Commerce Sellers Specifically. The news reveals that online platforms are outpacing supermarkets and hypermarkets, with innovative detergent formats—detergent sheets and ultra-concentrated liquids—being primarily launched through digital sales channels. This indicates that Amazon, Shopify, and specialized e-commerce platforms are becoming the primary distribution channels for product innovation, not traditional retail. For sellers, this means first-mover advantages exist in launching concentrated formats, subscription models, and specialized formulations (hypoallergenic, eco-friendly biodegradable solutions) that appeal to convenience-seeking consumers. The market shows clear segmentation: inorganic detergents dominate due to affordability (ideal for private-label sellers targeting price-sensitive buyers), while organic segments gain momentum in regulated regions like Europe and North America (premium positioning opportunity).

Asia Pacific Represents the Highest-Velocity Growth Zone. With rapid urbanization in China and India driving consumer transition from traditional cleaning methods to branded solutions, sellers targeting these regions face reduced competition from established brands. P&G's manufacturing expansion in Hyderabad, India signals major brand investment, but this creates supply chain opportunities for sellers to source locally and serve regional markets with localized, affordable offerings. The news explicitly identifies "significant opportunities for private-label brands and direct-to-consumer models, particularly in emerging markets"—this is a direct seller opportunity signal. Sellers can capitalize on the 4.29% CAGR by building inventory in concentrated formats and eco-friendly packaging before major brands saturate these channels.

Sustainability Packaging Shift Creates Differentiation Moat. The transition toward paper-based bottles and 100% recycled plastic reflects both consumer preferences and regulatory pressures in North America and Europe. Sellers who source sustainable packaging now will establish competitive advantages as regulations tighten. This is not a future trend—it's happening now in regulated markets, creating immediate cost-of-goods opportunities for sellers who can source compliant packaging at scale. The market explicitly notes this creates "differentiation opportunities for sellers targeting environmentally conscious demographics," indicating premium pricing potential alongside regulatory compliance.

Immediate Seller Opportunities: (1) Launch private-label concentrated detergent lines targeting Asia Pacific markets within 90 days; (2) Source sustainable packaging suppliers to establish regulatory compliance before Q2 2025; (3) Build subscription models on Shopify/Amazon leveraging the noted "subscription model" competitive advantage; (4) Develop hypoallergenic and eco-friendly variants for North America/Europe premium segments. Risk Mitigation: Monitor P&G, Unilever, and Henkel's e-commerce expansion strategies—major brands will aggressively defend market share. Avoid over-inventory in traditional formats; prioritize concentrated and sheet formats. Compliance deadline: Ensure sustainable packaging sourcing by Q2 2025 before regulatory enforcement accelerates.