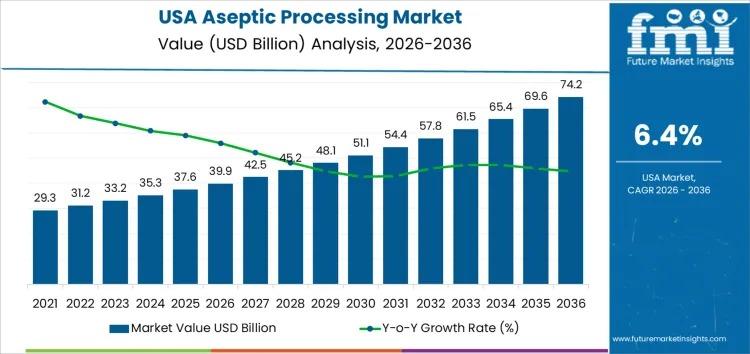

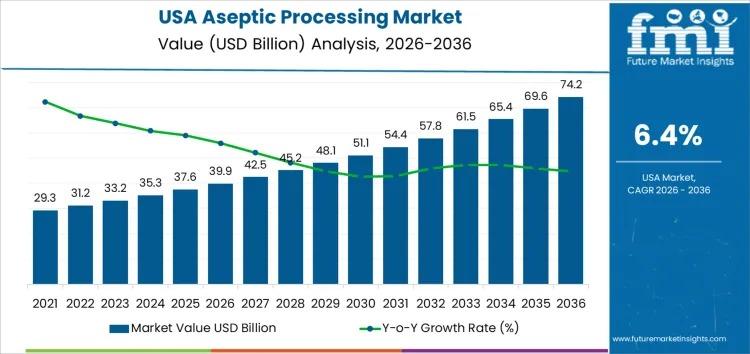

FDA/USDA Aseptic Compliance Surge Creates $34.3B Seller Opportunity Through 2036

- Market doubles from $39.9B (2026) to $74.2B (2036) at 6.4% CAGR; stringent sterility regulations eliminate non-compliant sellers and create high-barrier moats for certified suppliers

概览

The USA aseptic processing market is experiencing explosive growth driven by regulatory intensification and manufacturing demand, creating a critical compliance-driven opportunity for sellers in food, beverage, and pharmaceutical categories. Valued at USD 39.9 billion in 2026 and projected to reach USD 74.2 billion by 2036 (6.4% CAGR), this expansion is fundamentally driven by stringent FDA and USDA requirements for sterility assurance and contamination prevention. For e-commerce sellers, this represents both a barrier to entry and a competitive moat: manufacturers investing in aseptic compliance will dominate shelf-stable product categories, while non-compliant sellers face market elimination.

Compliance barriers are creating category winnowing at scale. The news identifies that manufacturers must meet "stringent FDA and USDA requirements while maintaining production efficiency and product quality at scale"—a dual mandate that eliminates small, under-resourced producers. Shelf-stable dairy, juices, sauces, soups, ready-to-drink beverages, and dairy alternatives are the primary categories affected. Sellers sourcing from non-compliant manufacturers face product seizures, delisting from Amazon/Walmart, and liability exposure. The fastest compliance path involves partnering with STERIS Corporation, Getinge, Sartorius, MilliporeSigma, or IMA Life—the five dominant players competing on "FDA/USDA compliance support." These partnerships typically cost $50K-$200K+ for system validation and certification, creating a 6-12 month timeline to market readiness. Estimated impact: 30-40% of current small-batch beverage and dairy sellers will be forced to upgrade or exit within 24 months.

Packaging innovation creates service gaps and margin opportunities. The market shows "paper and paperboard dominating" in carton-based beverage packaging, with "plastics supporting flexible and rigid containers with strong barrier properties." This signals that sellers offering aseptic-compliant packaging solutions—carton liners, barrier films, sterilizable containers—face explosive demand. Regional variation is critical: West USA (biopharmaceutical focus), South USA (beverage expansion), Northeast USA (pharmaceutical/biologics), and Midwest USA (dairy/packaged foods) each require different compliance certifications and packaging standards. Sellers can exploit this by offering region-specific compliance consulting services or pre-certified packaging bundles, capturing 8-15% margin premiums over standard packaging.

Automation and real-time monitoring create B2B seller opportunities. The news emphasizes that "automation, real-time monitoring, and flexible system design will shape purchasing decisions." This indicates demand for IoT sensors, monitoring software, and compliance documentation platforms that help manufacturers prove sterility assurance to regulators. Sellers offering SaaS compliance tracking, temperature/pressure monitoring dashboards, or automated FDA documentation tools can capture recurring revenue from the 5,000+ manufacturers upgrading aseptic systems through 2036. Market size for compliance services: estimated $2-4B annually by 2030.