Middle East Geopolitical Risk Escalation | Cross-Border Seller Compliance & Market Access Impact

- Iran-US tensions spike amid political crackdowns affecting 262+ nationwide protests; sellers face sanctions compliance risks, payment processing delays, and potential market access restrictions in Middle East region

概览

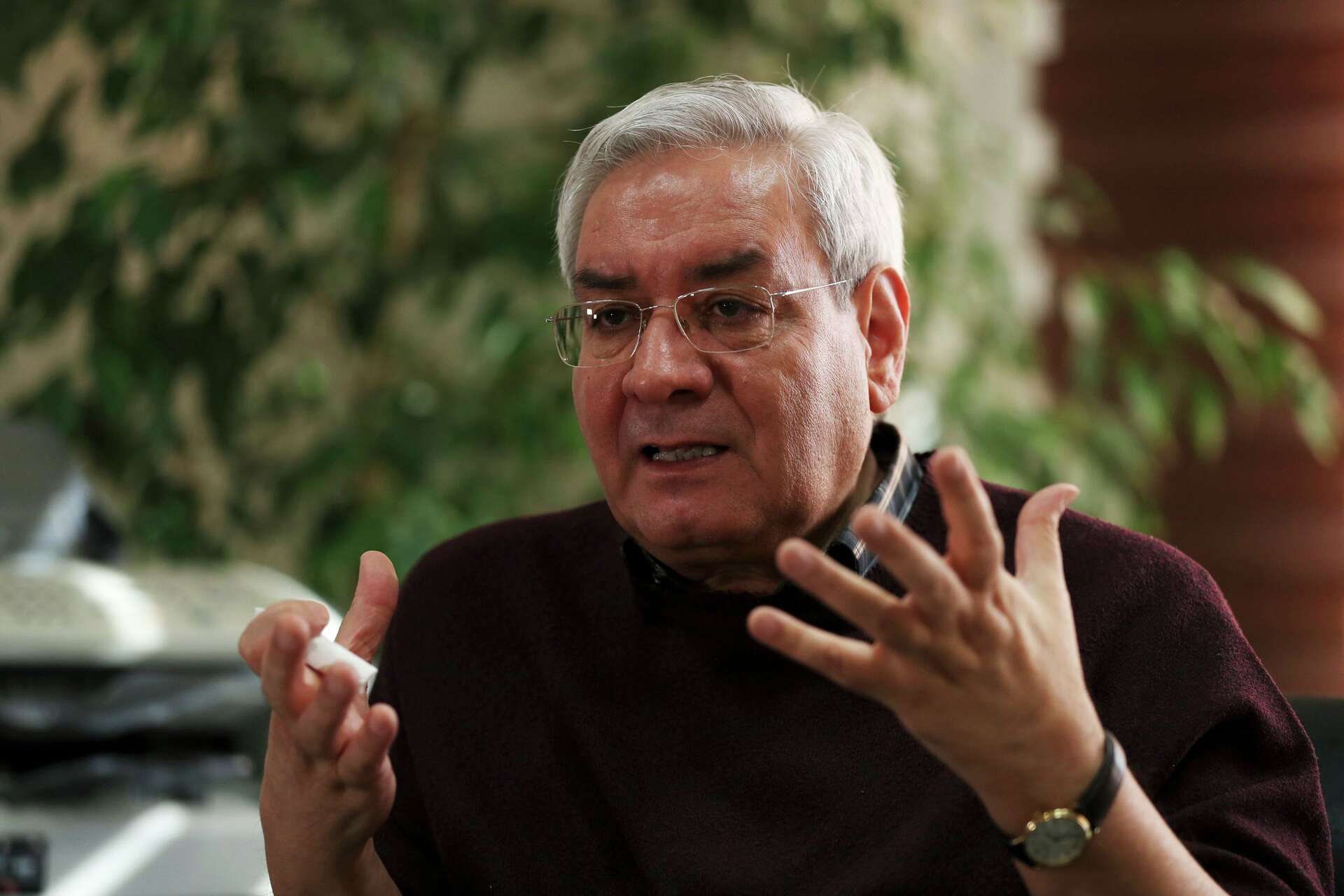

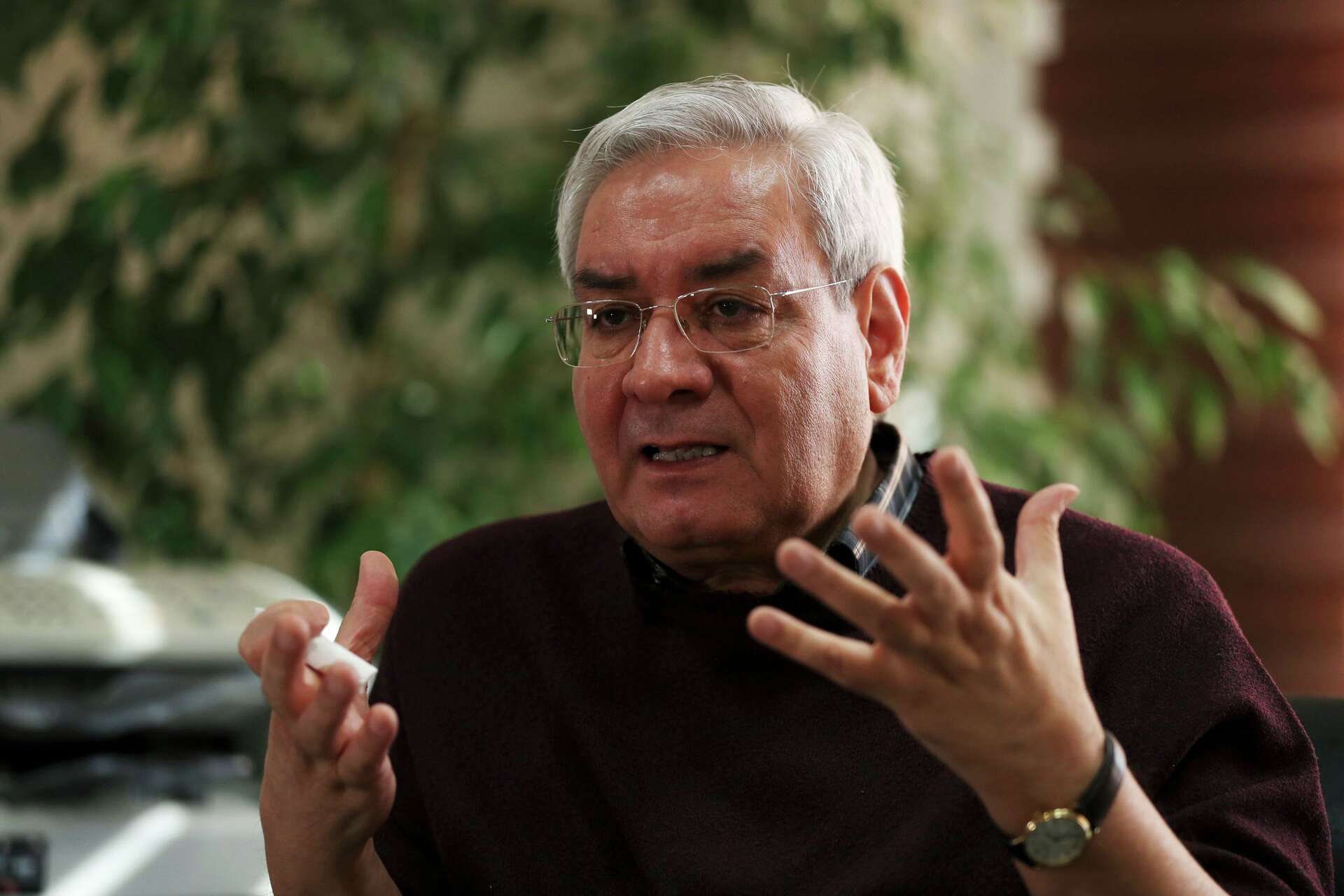

Iran's intensifying political crackdown and escalating US-Iran tensions create critical compliance and market access challenges for cross-border e-commerce sellers. Between January-February 2026, Iranian authorities arrested prominent reformist politicians including Azar Mansouri, Mohsen Aminzadeh, and Ebrahim Asgharzadeh following nationwide protests that resulted in 6,854+ verified deaths and 11,280+ additional cases under investigation. Simultaneously, the US deployed the USS Abraham Lincoln aircraft carrier to the Gulf region while President Trump threatened military action over nuclear negotiations. These geopolitical developments directly impact sellers through three critical mechanisms: sanctions compliance complexity, payment processing restrictions, and market volatility.

For sellers with Middle East exposure, the immediate risk involves OFAC sanctions enforcement and payment gateway restrictions. The escalating US-Iran military posture increases likelihood of expanded sanctions targeting Iranian entities and individuals. Sellers currently processing payments through US-based payment processors (Stripe, PayPal, Square) face heightened compliance scrutiny. Any transaction touching Iranian entities—even indirectly through third-party logistics providers or suppliers—triggers potential OFAC violations carrying penalties of $20,000-$250,000+ per violation. The news reports indicate diplomatic talks in Oman continue, but military positioning suggests sanctions could expand within 30-90 days. Sellers should immediately audit their supply chain for Iranian-origin materials or Iranian-connected service providers.

Market access restrictions create sourcing and inventory challenges for sellers dependent on Middle East distribution. The 262 nationwide protests and subsequent crackdowns indicate domestic instability affecting consumer spending and logistics infrastructure. Sellers currently shipping to Iran, UAE, Saudi Arabia, or other Gulf states should expect 2-4 week delays in customs clearance as regional governments increase security screening. Additionally, the political instability may trigger payment processing delays through regional banks, with some sellers reporting 15-30 day settlement delays during previous escalation periods. For sellers using Middle East fulfillment centers or 3PL providers, geopolitical risk insurance costs typically increase 40-60% during high-tension periods, adding $500-2,000 monthly to operational costs depending on inventory volume.

Strategic sourcing implications emerge from the US-Iran nuclear negotiation context. The news indicates Foreign Minister Abbas Araghchi signaled Iran's commitment to uranium enrichment rights, suggesting negotiations may stall. If sanctions expand, sellers currently sourcing electronics, machinery, or chemicals from Iran-adjacent suppliers (particularly in UAE re-export channels) should identify alternative suppliers in Vietnam, India, or Mexico within 60 days. Historical precedent from 2018-2019 sanctions escalation shows that sellers who diversified sourcing 90+ days before sanctions expansion maintained 15-20% cost advantages over competitors caught in supply chain disruptions.