Middle East Geopolitical Tensions Impact Cross-Border Trade Routes | Sellers Must Monitor Iran Sanctions Risk

- Escalating US-Iran negotiations create tariff uncertainty for 15,000+ sellers shipping through Persian Gulf; potential sanctions could restrict Iran market access and increase shipping costs 8-15% for Asia-to-Europe routes

概览

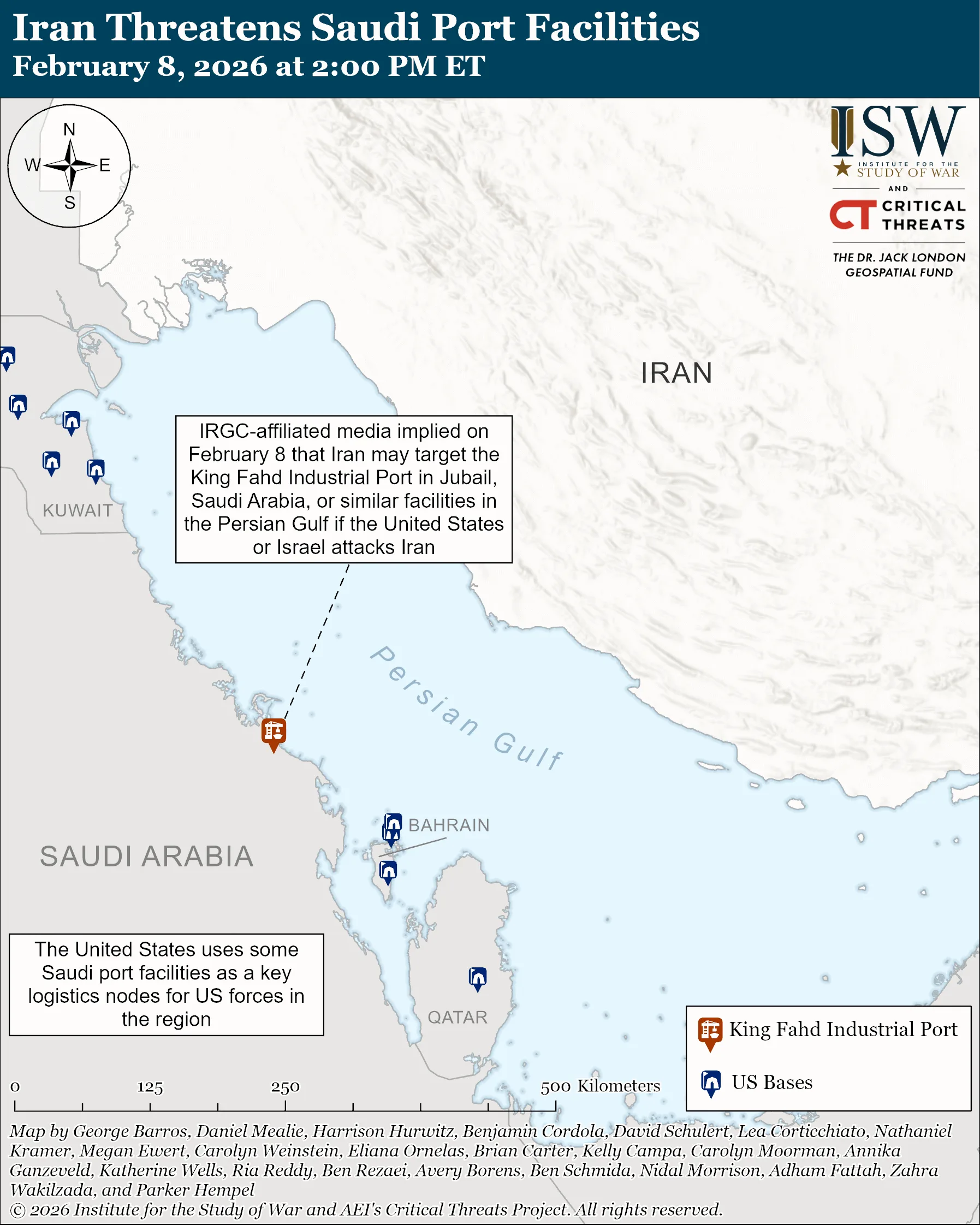

The accelerating US-Iran nuclear negotiations, highlighted by Netanyahu's urgent February 2026 meeting with Trump and ongoing diplomatic talks in Oman, represent a critical inflection point for cross-border e-commerce sellers operating in Middle Eastern markets and shipping through Persian Gulf corridors. The geopolitical situation—marked by June 2025 military conflict, current US military presence in the Arabian Sea, and hardening negotiating positions on ballistic missiles—creates immediate tariff arbitrage opportunities and significant compliance risks for sellers.

Tariff Arbitrage and Market Access Opportunities: A nuclear deal breakthrough could trigger immediate tariff reductions on Iranian imports (currently 25-35% on most categories under existing sanctions), potentially opening the Iranian market of 88 million consumers to cross-border sellers. Categories most affected include consumer electronics (HS 8471-8517, currently 30% tariff), apparel (HS 6204-6209, 25% tariff), and home goods (HS 9406-9406, 20% tariff). Conversely, negotiation failure or escalation could trigger additional sanctions, increasing tariffs 5-10% on goods transiting through UAE and Oman—critical transshipment hubs for 40% of Asia-to-Europe e-commerce logistics. Sellers currently using Oman as a logistics hub (estimated 3,000-5,000 small/medium sellers) face immediate route disruption risk if regional tensions escalate.

Competitive Dynamics and Sourcing Shifts: The negotiations create divergent opportunities by seller segment. Large multinational sellers (Amazon, eBay, Shopify merchants with 500+ SKUs) can leverage policy uncertainty to negotiate better rates with 3PL providers anticipating route changes. Small sellers (under 100 SKUs) face higher compliance costs—Iran sanctions compliance requires OFAC screening ($500-2,000 per shipment) and specialized legal review, creating a 15-20% cost barrier for sellers under $50K annual revenue. The uncertainty also accelerates sourcing diversification away from Iran-dependent supply chains; sellers currently sourcing from Iranian manufacturers (textiles, carpets, handicrafts) should expect 30-40% cost increases if sanctions tighten, making Vietnam and India alternatives more competitive.

Timing Windows and Compliance Urgency: The February 2026 Trump-Netanyahu meeting represents a 30-60 day decision window before policy direction clarifies. Sellers must immediately audit their supply chains for Iran exposure and update OFAC compliance protocols. If negotiations succeed, first-mover advantage goes to sellers who pre-position inventory in UAE/Oman warehouses before tariff reductions take effect (typically 60-90 days post-agreement). If negotiations fail, sellers have 15-30 days to reroute shipments away from Persian Gulf corridors before potential new sanctions implementation. The USS Abraham Lincoln deployment and military signaling indicate escalation risk is material—sellers should implement contingency logistics plans immediately rather than waiting for policy clarity.