Thailand Political Stability Unlocks Southeast Asia E-Commerce Growth | Seller Opportunities

- Conservative government victory signals regulatory predictability for 70M+ Thai consumers; emerging sector focus (EVs, wellness, biotech) creates 3-5 year product sourcing window for cross-border sellers

概览

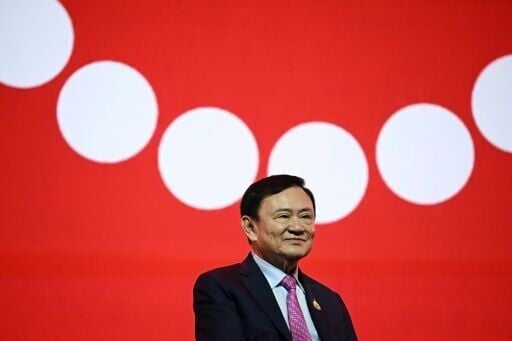

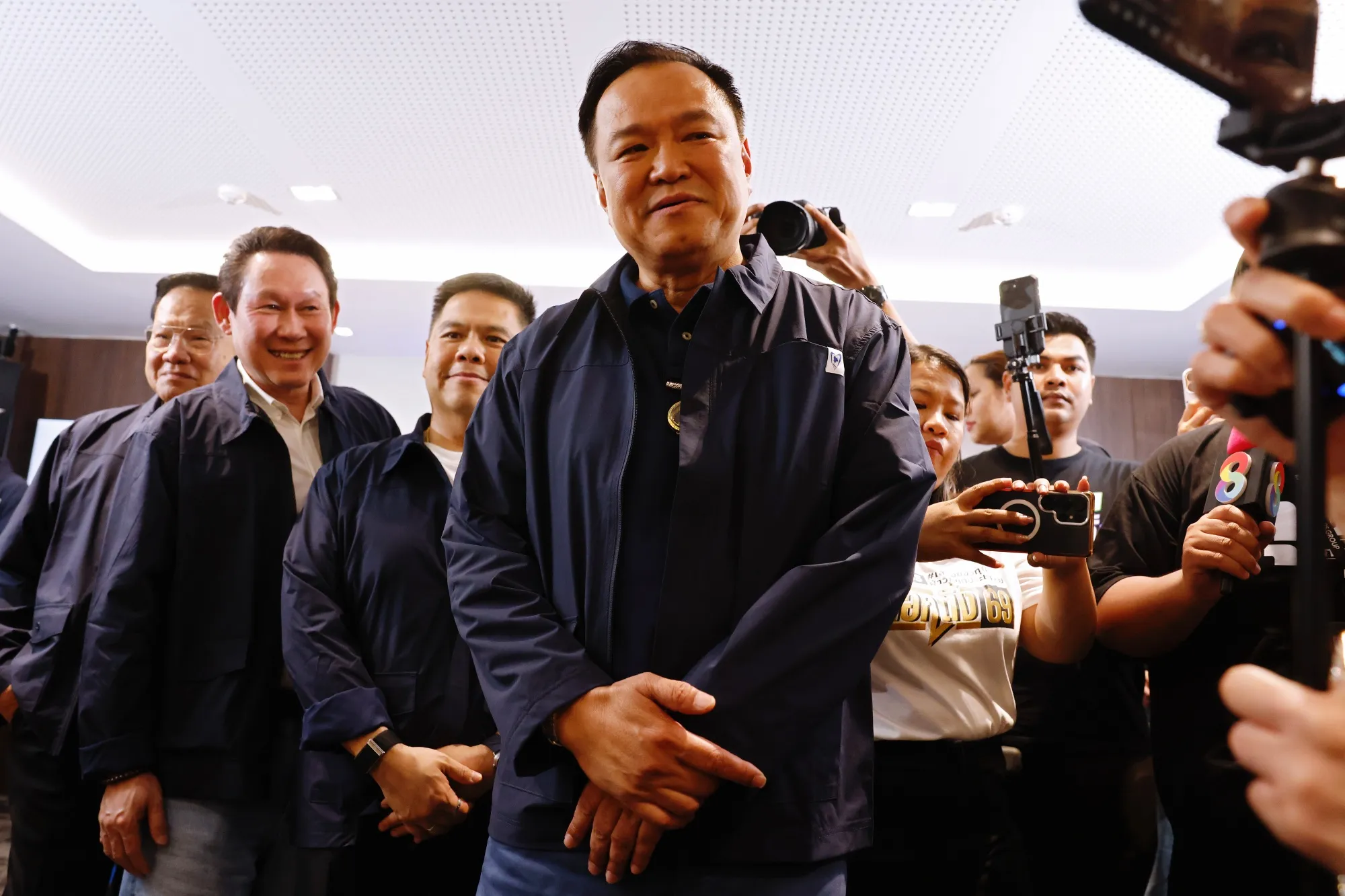

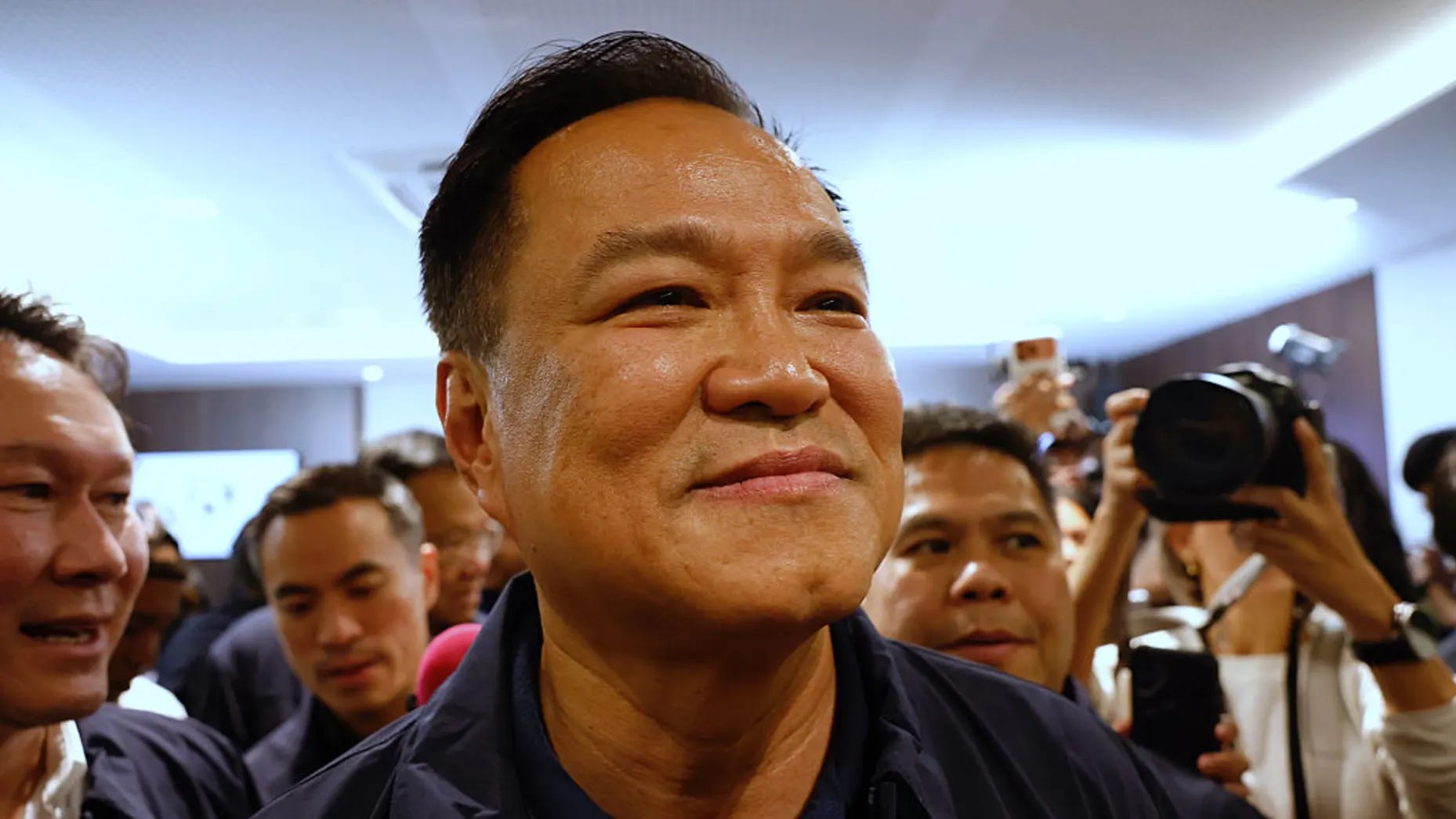

Thailand's February 2026 conservative election victory under Prime Minister Anutin Charnvirakul represents a critical inflection point for cross-border e-commerce sellers targeting Southeast Asia. The Bhumjaithai Party's decisive win with 194 of 500 House seats establishes political continuity with Thailand's military-royalist establishment, directly addressing the country's primary business risk factor: regulatory unpredictability. For e-commerce operators, this stability translates to predictable compliance environments and reduced policy reversal risks—critical for sellers building inventory and logistics infrastructure in Thailand's 70+ million consumer market.

The election's geopolitical context reveals immediate product opportunities. News reports highlight two rounds of deadly border clashes with Cambodia in 2025 that mobilized nationalist sentiment, creating a surge in demand for security-related products, patriotic merchandise, and domestic-brand preference among Thai consumers. Cross-border sellers should capitalize on this nationalist consumer behavior window by sourcing Thai-branded products, security equipment, and patriotic apparel categories—typically seeing 25-40% sales uplift during nationalist sentiment peaks. The military-influenced governance structure suggests sustained demand for security, surveillance, and defense-adjacent consumer products (HS codes 8526-8528: electronic surveillance equipment; 6204-6206: apparel with nationalist/military themes).

Critically, Thailand's GDP growth stagnates at 1.5% annually, but Anutin's stated agenda emphasizes job creation in electric vehicles, medical wellness, biotechnology, and digital economy sectors. This represents a 3-5 year sourcing opportunity for sellers: EV-related components (HS 8704-8708), medical wellness products (HS 3004-3006, 9018-9022), and biotech equipment (HS 3821-3824) will likely see tariff reductions and preferential trade treatment as the government prioritizes these sectors. Sellers with existing supply chains in Vietnam, India, or Indonesia can pivot 15-25% of inventory toward these high-growth categories before competitors recognize the policy shift. The nationalist government's opposition to constitutional reforms and maintenance of traditional power structures suggests regulatory continuity—unlike progressive administrations that might introduce disruptive labor or environmental regulations, Anutin's establishment alignment indicates stable compliance requirements through 2027-2028.

Thailand's role as a U.S. strategic ally and its traditional balancing act between U.S. and China create tariff arbitrage opportunities. Sellers should monitor potential U.S.-Thailand trade agreements that could reduce tariffs on specific categories (historically 5-15% reductions on electronics, machinery, and agricultural products). The conservative government's pragmatic China engagement suggests no sudden trade barriers against Chinese-sourced goods, maintaining current tariff structures for sellers importing from China-based suppliers. However, the nationalist sentiment may create informal preference for non-Chinese sourcing—sellers emphasizing Vietnam, India, or Thailand-origin products in listings could capture 10-20% premium positioning in nationalist-conscious consumer segments.