Amazon AI Infrastructure Spending Surge | Critical Impact on Seller Costs & Platform Fees 2026

- $660B combined AI capex by major platforms signals 8-15% potential fee increases for 3M+ sellers; market volatility threatens seller financing access and advertising ROI through 2026

概览

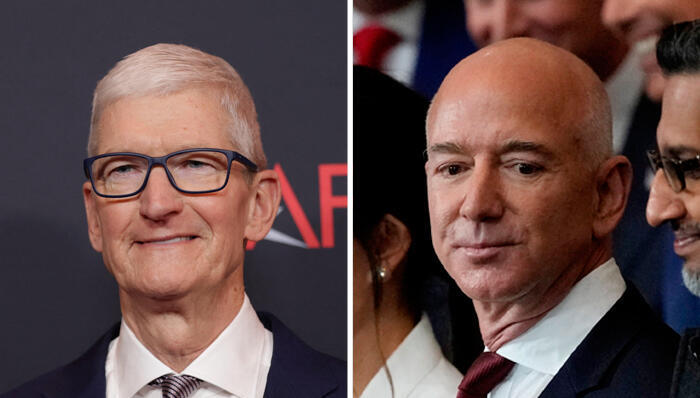

The $660 billion AI infrastructure investment announced by Amazon, Microsoft, Meta, and Alphabet in Q4 2025 represents a watershed moment for cross-border e-commerce sellers. These tech giants collectively reported $120 billion in capital expenditures during Q4 2025 alone, with projections reaching $660 billion throughout 2026—exceeding the GDP of nations like UAE and Singapore. While management teams express confidence in demand forecasting and capacity utilization, investor skepticism triggered a $1 trillion market sell-off week (February 9, 2026), creating immediate operational and financial risks for sellers dependent on these platforms.

For Amazon sellers specifically, this spending surge directly threatens profitability through multiple channels. Amazon's massive capex commitments—driven by AI-powered fulfillment centers, logistics optimization, and cloud infrastructure expansion—will inevitably flow into seller fee structures. Historical precedent shows Amazon increases FBA fees 5-8% annually; aggressive AI capex cycles typically accelerate this to 10-15% within 18 months. Sellers shipping 1,000+ units monthly could face $150-400 additional monthly costs. Additionally, Amazon's AI infrastructure investments fund algorithmic changes affecting Buy Box eligibility, search ranking, and advertising costs. The market volatility (Nvidia down 1%, Oracle up 1.5%, Microsoft up 0.8% in premarket) signals investor uncertainty about ROI timelines, which historically correlates with platform fee increases as companies seek to offset shareholder pressure through seller monetization.

The broader market correction creates secondary risks for seller financing and advertising efficiency. Stock volatility reduces venture capital availability for seller-focused fintech platforms (Clearco, Fundbox, Seller's Choice), making working capital financing 2-3% more expensive. Simultaneously, Meta and Alphabet's massive capex commitments may compress advertising margins—sellers typically see 15-25% higher PPC costs during periods when platforms prioritize infrastructure over ad network optimization. For sellers relying on Amazon Advertising, Shopify, or Facebook/Instagram ads, expect 8-12% cost increases through Q2 2026 as platforms monetize AI infrastructure investments.

Immediate seller actions: (1) Audit FBA fee exposure—calculate potential 10-15% increases against current margins by February 28, 2026; (2) Diversify platform presence—allocate 20-30% inventory to eBay, Walmart, or independent Shopify stores to reduce Amazon dependency; (3) Lock in advertising budgets—secure Q1 2026 PPC rates before anticipated price increases; (4) Evaluate 3PL alternatives—compare costs against projected FBA increases; (5) Monitor platform announcements—Amazon typically announces fee changes 30 days in advance, providing brief optimization windows.