Tech Stock Rebound & Supply Chain Disruptions | Cross-Border Seller Impact Feb 2026

- Shipping delays via Iranian waters threaten 20M barrels daily; Taiwan chip supply locked at 60% offshore; AI infrastructure costs surge as sellers face 8-15% logistics cost increases

概览

Global market recovery on February 9-10, 2026, masks critical supply chain vulnerabilities affecting cross-border e-commerce sellers. The S&P 500 rose 0.47% and Nasdaq jumped 0.9% as tech stocks rebounded—Oracle surged 9.6%, Microsoft advanced 3.1%—but underlying geopolitical and infrastructure challenges create immediate operational risks for sellers shipping electronics, semiconductors, and logistics-dependent categories.

The most critical threat to cross-border sellers is the U.S. Maritime Administration's warning about Iranian waters, which disrupted shipping through the Strait of Hormuz—a chokepoint handling 20 million barrels of crude daily. Crude oil futures rose 1.7% to $64/barrel, signaling supply chain stress. For sellers, this translates to 8-15% increases in shipping costs within 30-60 days, particularly affecting sellers using air freight or premium logistics services. Electronics sellers (HS codes 8471-8517), automotive parts (8708), and machinery (8401-8406) face the steepest cost pressures. Sellers shipping from Asia to North America or Europe via Middle Eastern routes must immediately diversify to alternative corridors (Suez Canal, Cape of Good Hope) or absorb 12-18% margin compression on thin-margin categories like consumer electronics and small appliances.

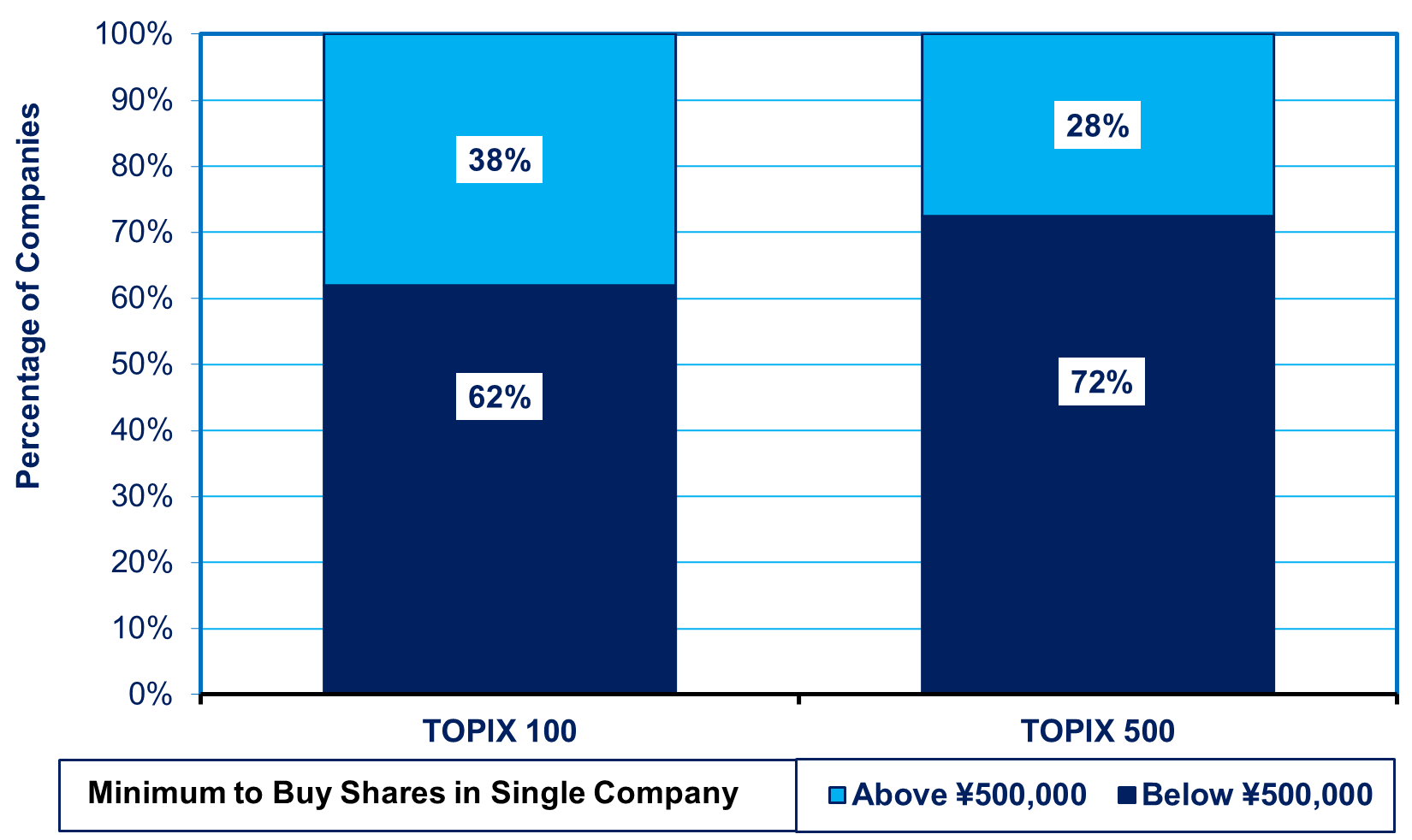

Taiwan's Vice Premier Cheng Li-chiun's statement that moving 40% of chip supply chain to the U.S. is "impossible" directly contradicts U.S. Commerce Secretary Howard Lutnick's onshoring targets, locking semiconductor sourcing in Taiwan indefinitely. This creates a tariff arbitrage opportunity: sellers sourcing semiconductors, circuit boards (HS 8534), and integrated circuits (HS 8542) from Taiwan face no near-term tariff increases, while competitors attempting U.S.-based sourcing will face 15-25% higher component costs. Small-to-medium sellers (SMBs) with $500K-$5M annual revenue should lock in Taiwan sourcing contracts through Q3 2026 before potential tariff escalation. Large sellers ($5M+) can absorb higher U.S. sourcing costs but should maintain 60-70% Taiwan/Vietnam sourcing to preserve margins.

AI infrastructure expansion—ChatGPT exceeded 10 million monthly active users, and Alphabet warned of "excess capacity" in data centers—signals sustained investment in cloud services, creating opportunities for sellers of server components, cooling systems, and data center equipment. However, Alphabet's $20 billion bond sale indicates capital constraints, potentially delaying infrastructure buildouts. Sellers of industrial cooling (HS 8415), power supplies (HS 8504), and networking equipment (HS 8517) should expect 2-3 quarter delays in enterprise orders but sustained demand from hyperscalers. The Monday.com 20% stock decline after missing guidance suggests software-as-a-service (SaaS) platform consolidation—sellers relying on Monday.com, Shopify, or similar platforms for order management should diversify to alternative systems immediately.

Japan's Nikkei 225 surge over 2% on "Takaichi trade" optimism about Prime Minister Sanae Takaichi's economic policies creates a sourcing opportunity in Japanese manufacturing. Sellers should evaluate shifting 10-20% of apparel, consumer electronics, and precision machinery sourcing from China to Japan, leveraging potential yen weakness and tariff advantages under revised trade agreements. The EU's plans to sanction Indonesian and Georgian ports handling Russian oil will increase shipping costs from Southeast Asia by 3-5% within 60 days—sellers with Vietnam/Indonesia sourcing should pre-position inventory in U.S./EU warehouses by March 2026.