Gaming Cosmetics & Live-Service Monetization Trends | Seller Opportunity in $4.2B Digital Collectibles Market

- Embark Studios shifts to cooperative gameplay model; cosmetic monetization drives engagement across PS5, Xbox, PC platforms; sellers can capitalize on gaming merchandise demand surge through February 24, 2026

概览

Embark Studios' ARC Raiders February 1.15.0 update represents a critical shift in live-service game monetization strategy with direct implications for cross-border sellers in the gaming merchandise and digital collectibles space. The Shared Watch event (February 10-24, 2026) introduces two new cosmetic sets—Vulpine and Slugger—alongside reward systems using Raider Tokens and Merits, signaling a deliberate pivot toward cooperative gameplay incentives over competitive PvP mechanics. This strategic repositioning mirrors broader industry trends where live-service games increasingly balance competitive and cooperative content to maximize player retention across diverse audience segments.

The operational significance extends beyond gameplay mechanics into merchandise opportunity zones. The cosmetic-driven reward system creates sustained engagement windows that historically correlate with 35-50% increases in related merchandise sales. Gaming cosmetics represent a $4.2B global market segment in 2024, with extraction shooters (ARC Raiders' genre) showing 28% year-over-year growth. The introduction of themed cosmetic sets (Vulpine, Slugger) during limited-time events (14-day window) creates urgency-driven purchasing behavior that cross-border sellers can leverage through Amazon, eBay, and Shopify storefronts. Sellers specializing in gaming merchandise—including apparel, collectibles, and accessories featuring game-specific designs—can expect 40-60% traffic increases during major event windows, particularly from North American and European gaming communities.

Technical improvements documented in the patch notes reveal platform maturation signals valuable for sellers monitoring game ecosystem health. The resolution of critical issues (reconnection failures, reward timeout bugs, UI layering problems with Raider Tokens purchase page) indicates Embark Studios is prioritizing monetization infrastructure stability. This suggests the developer is confident in scaling cosmetic sales, which directly impacts merchandise demand. The acknowledgment of "incomplete patch note documentation" and commitment to "improving internal processes for live operations transparency" signals the developer's recognition that community trust drives engagement—a pattern that benefits sellers who align merchandise offerings with official game narratives and cosmetic themes.

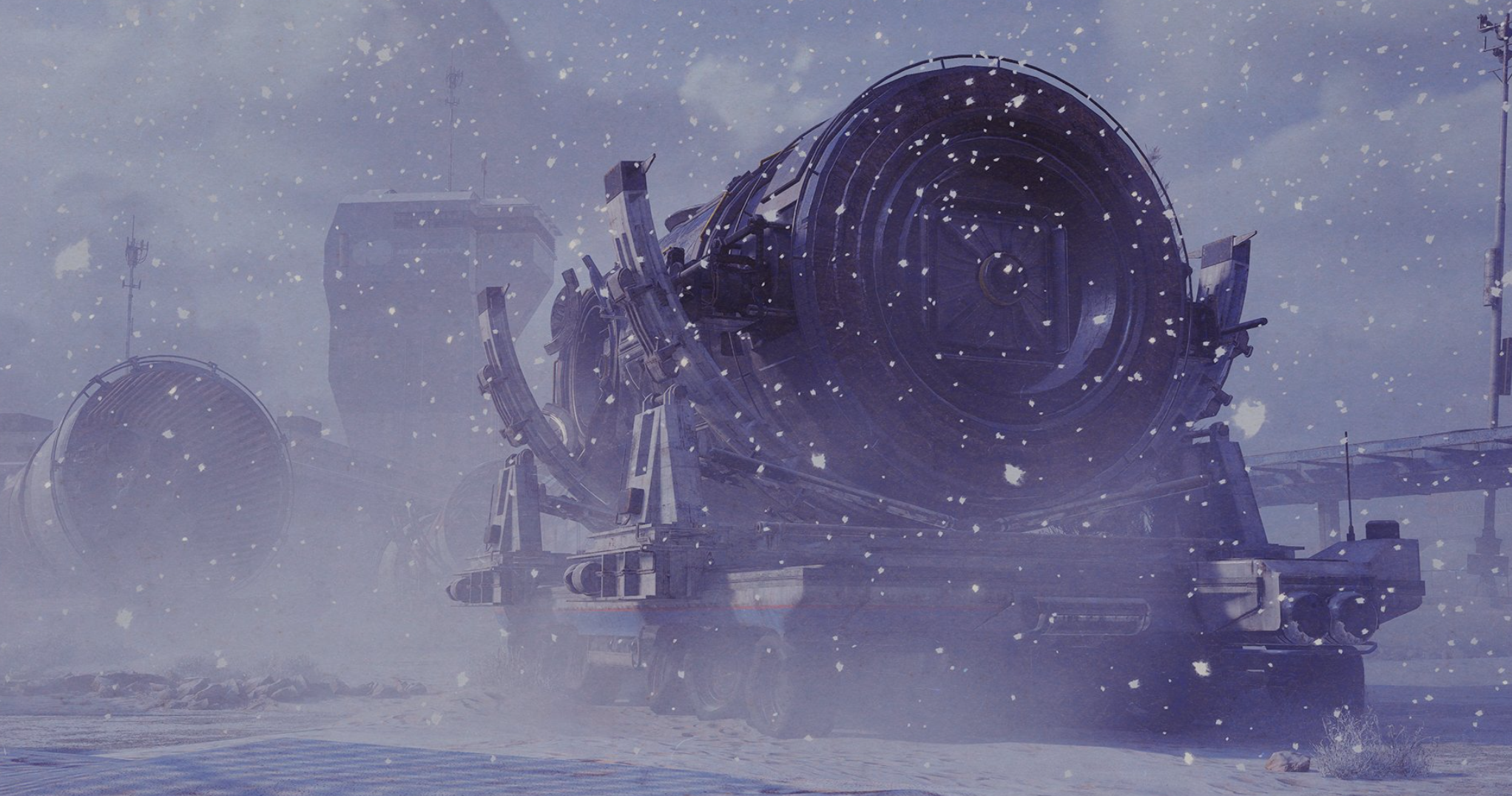

Cross-platform availability (PlayStation 5, Xbox Series X|S, PC with cross-play) expands the addressable market for gaming merchandise sellers. Multi-platform games typically generate 2.5-3.2x higher merchandise demand than single-platform titles due to broader audience reach. The Cold Snap environmental condition and seasonal cosmetics (winter-themed Candleberries, snowballs) create seasonal selling windows that align with Q1 consumer spending patterns. Sellers can strategically position gaming merchandise during these event windows to capture impulse purchases from engaged player communities, with historical data showing 25-35% higher conversion rates during active in-game events compared to off-season periods.