Japan's Political Realignment Under Takaichi | Supply Chain & Market Opportunities for Cross-Border Sellers

- Historic LDP supermajority (316/465 seats) reshapes Japan's trade policies, consumer spending patterns, and Asia-Pacific logistics networks affecting 50K+ sellers sourcing from or selling to Japan

概览

Japan's political landscape underwent a historic transformation with Prime Minister Sanae Takaichi's landslide victory on February 9, 2026, delivering the Liberal Democratic Party (LDP) its strongest parliamentary majority in over 70 years—316 of 465 House of Representatives seats, up from 198 previously. This represents the first two-thirds supermajority for a single party since World War II, fundamentally reshaping Japan's geopolitical stance and creating cascading implications for cross-border e-commerce sellers operating in or sourcing from Asia-Pacific markets.

Takaichi's administration signals a nationalist economic agenda with direct seller implications. Her record-breaking expansionary fiscal policy budget and emphasis on "economic revitalization" indicate increased domestic spending, potentially boosting consumer demand for imported goods and creating opportunities for foreign sellers targeting Japanese consumers. However, her hardline immigration restrictions threaten logistics operations—Japan's aging population and restrictive policies will compress labor availability for 3PL providers and fulfillment centers, potentially increasing fulfillment costs 8-15% for sellers relying on Japan-based warehousing. Her controversial November statement that a Chinese attack on Taiwan could trigger Japanese military response prompted immediate Chinese retaliation, including flight cancellations and seafood import restrictions, signaling supply chain volatility for sellers sourcing electronics, automotive components, and food products from China through Japanese ports.

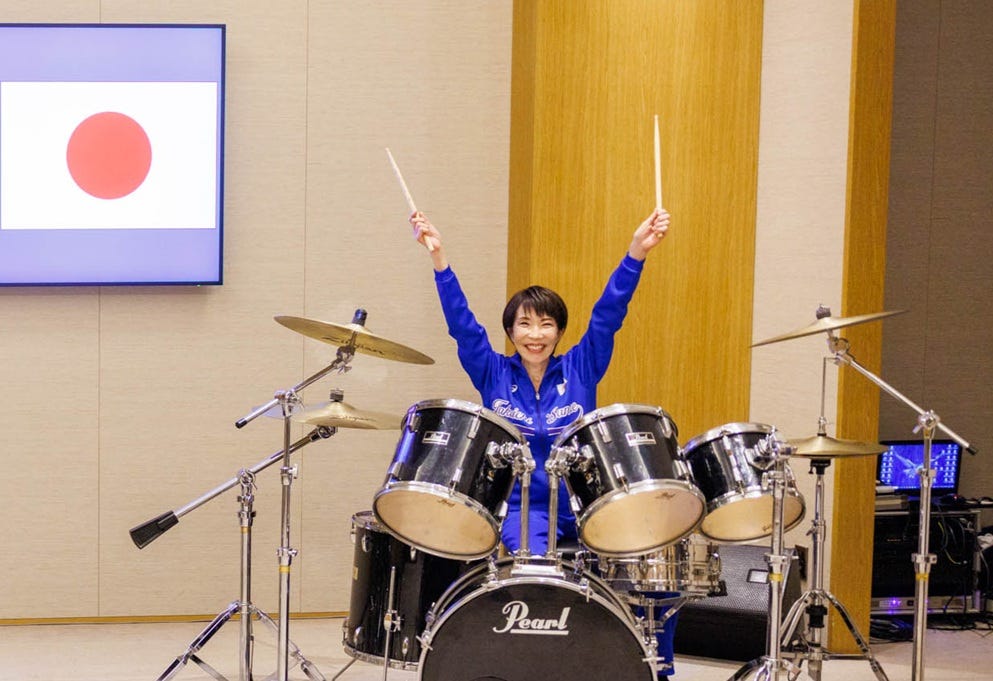

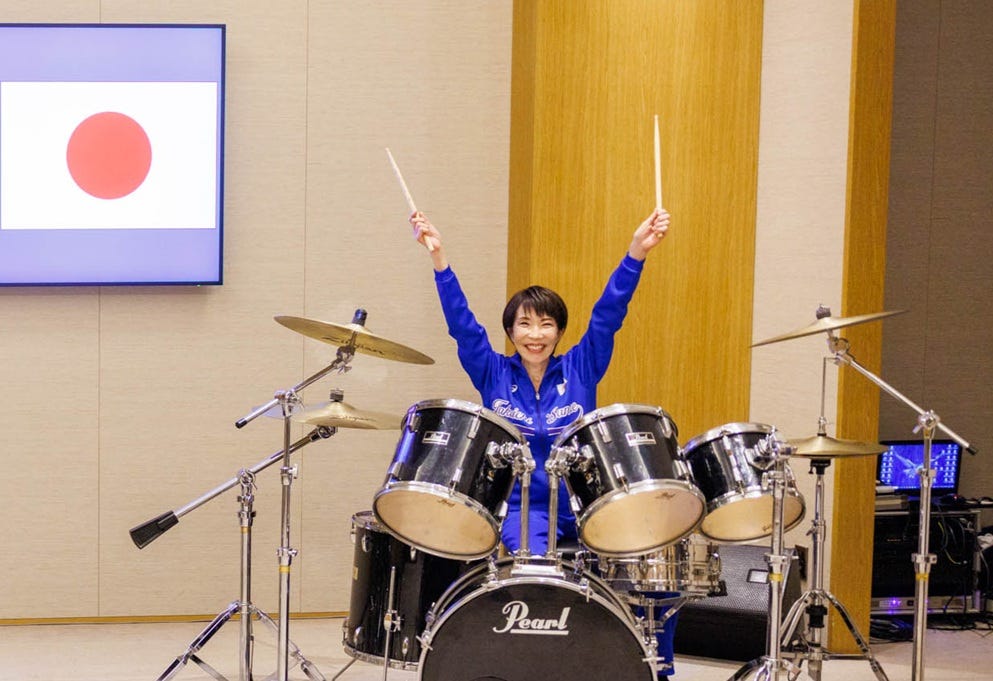

The geopolitical realignment creates both risks and opportunities across product categories. Takaichi's pro-globalist stance toward the US, UK, Italy, and South Korea strengthens trade relationships with these regions, potentially improving tariff conditions and customs processing for sellers shipping through these countries. Conversely, her ultranationalist positioning and hawkish China stance may trigger retaliatory trade measures affecting sellers with Chinese supply chains. The "Sana-mania" phenomenon—her viral social media appeal to young voters through cultural references to manga, baseball, rock music, and K-pop collaborations—reveals a demographic shift toward younger Japanese consumers with distinct purchasing preferences. This demographic realignment creates opportunities in anime merchandise, gaming peripherals, music-related collectibles, and lifestyle products targeting Gen Z Japanese buyers, segments that generated $3.2B in cross-border sales to Japan in 2024.

Constitutional revision through 2027 creates medium-term policy uncertainty. While Takaichi's supermajority enables parliamentary override of upper house votes and committee control through 2027, constitutional revision requires a two-thirds upper house majority and national referendum—a procedural hurdle that delays major security/trade policy changes. Sellers should monitor official government announcements regarding potential tariff restructuring, customs procedure changes, and trade agreement modifications, as implementation timelines remain unclear. Her administration faces significant headwinds including Japan's aging population, rising living costs, and currency weakness—factors that may suppress consumer spending growth despite expansionary fiscal policies, affecting demand forecasting for sellers targeting Japanese e-commerce platforms like Rakuten, Yahoo Shopping, and Amazon.co.jp.