Housing Market Lock-In Effect Crushes Consumer Spending | Home Goods E-Commerce Impact 2026

- Extended homeownership tenure (8.55 years avg) reduces furniture, décor, and home improvement e-commerce demand by estimated 15-25% as 31-year sales lows signal consumer financial constraints

概览

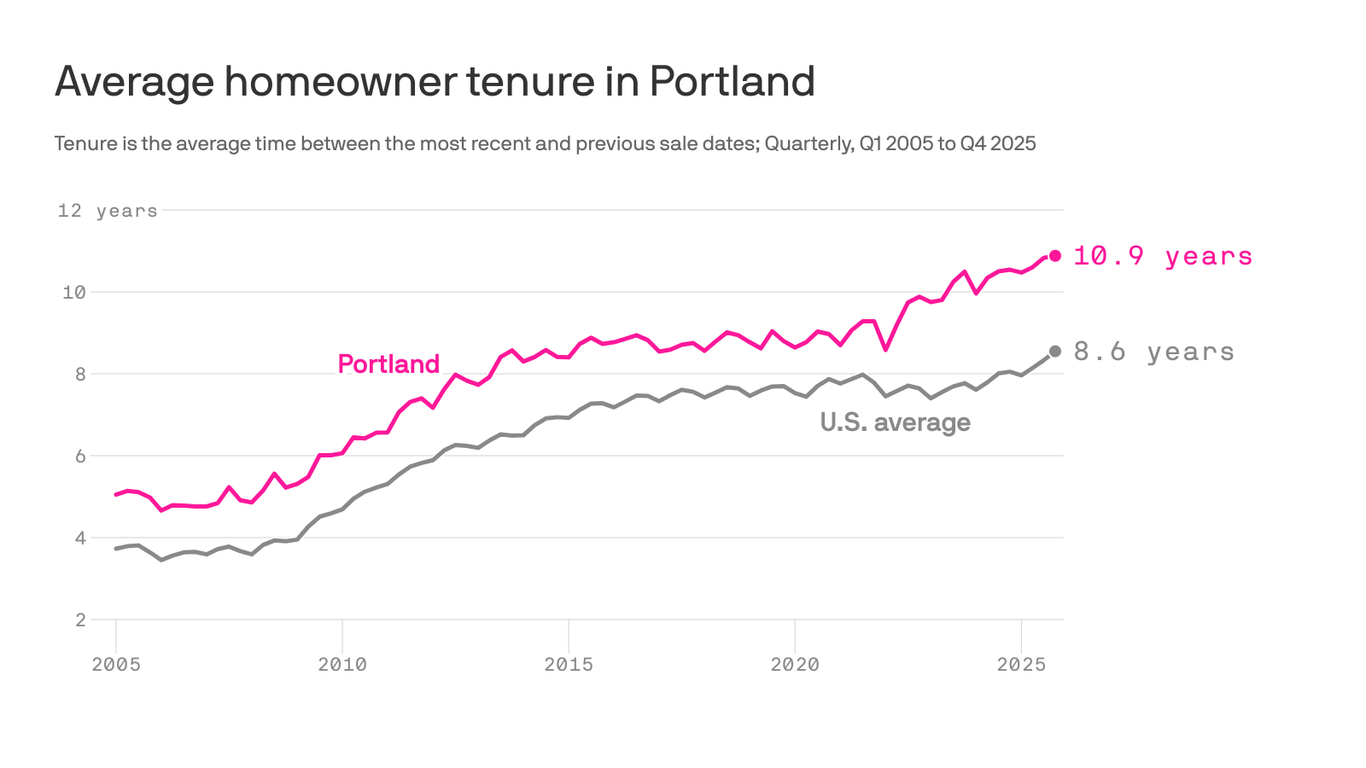

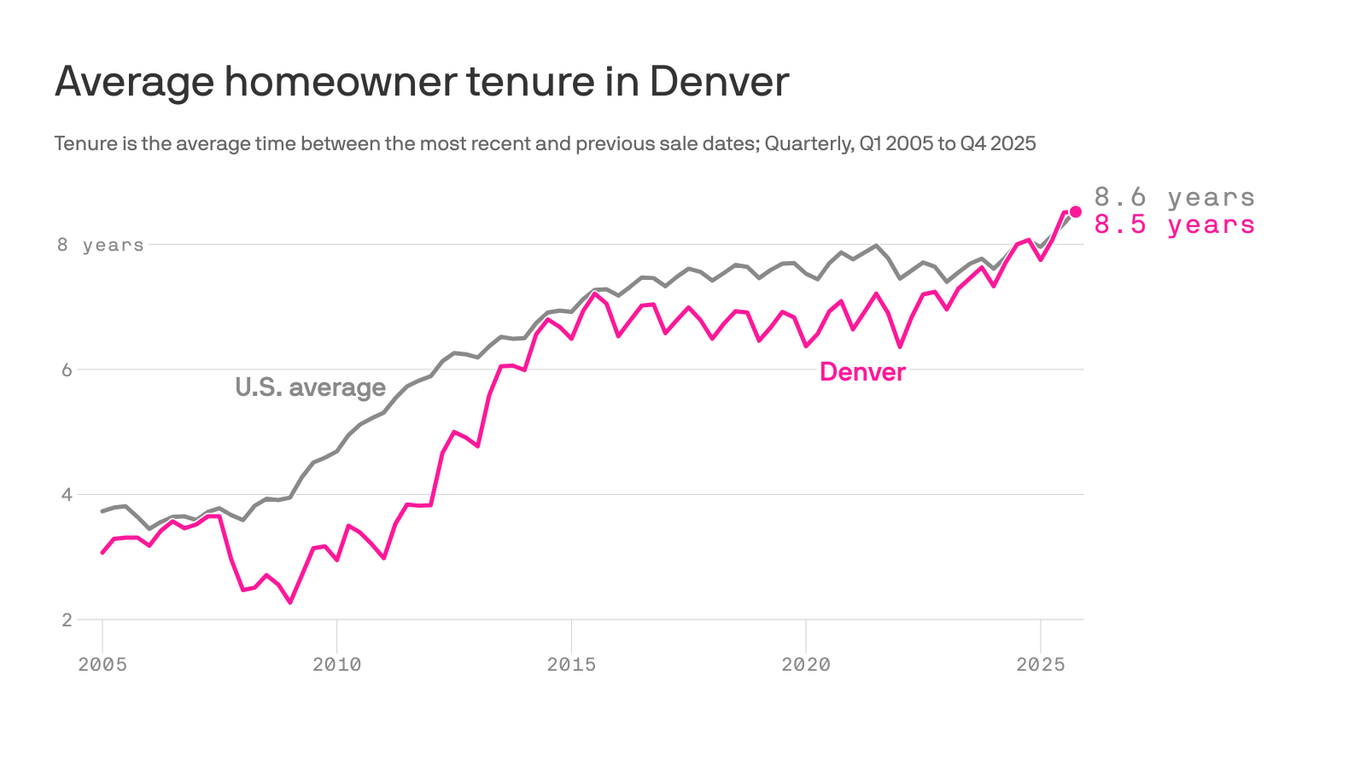

The U.S. housing market faces a structural crisis that directly impacts e-commerce consumer behavior and discretionary spending patterns. According to ATTOM data from Q4 2025, American homeowners are retaining properties for an average of 8.55 years—the longest tenure in 25 years and more than double the 4.2-year average from early 2000. This "lock-in effect" stems from homeowners' reluctance to surrender pandemic-era ultra-low mortgage rates (sub-3%) combined with elevated home prices averaging $357,000 nationally ($636,000 in Massachusetts, $755,000 in California). Home sales have plummeted to 31-year lows, signaling unprecedented affordability challenges that constrain consumer purchasing power across home-related categories.

The e-commerce impact is substantial and measurable. Extended homeownership tenure directly correlates with reduced spending on furniture, home décor, kitchen appliances, and home improvement products—categories representing $180-220B in annual U.S. e-commerce volume. When homeowners remain in properties 2-3 years longer than historical averages, they defer major home purchases, renovations, and furnishing upgrades. Coastal markets show the strongest retention patterns: Massachusetts homeowners average 13.29 years tenure (up 4.1 years year-over-year), while Connecticut averages 13.02 years. These high-cost markets experience the most severe affordability constraints, directly suppressing discretionary home goods spending among affluent demographics who typically drive premium furniture and décor sales.

Secondary market dynamics amplify the constraint. Cotality's analysis reveals a record 340,000 homes were transferred through inheritance during the 12-month period ending August 2025—representing 7% of all property transfers, the highest share since tracking began. California exemplifies this trend, where inherited properties doubled the number of newly constructed homes sold. These inheritance transfers remove properties from the active market, further limiting inventory and sustaining elevated prices. Proposition 13's tax incentives (2% annual increases, $1M exemptions on inherited primary residences) encourage families to retain inherited properties rather than sell, creating a multi-generational housing stagnation that extends the consumer spending freeze across decades.

Market recovery signals suggest modest improvement ahead. First American economist Sam Williamson identifies inventory stabilization as the critical variable for 2026 recovery. Early indicators show the lock-in effect easing: for the first time since 2020, more U.S. homeowners now carry mortgage rates of 6% or higher compared to those holding sub-3% loans—a development that could incentivize increased home sales activity. Buyers report increased listing options and price reductions, suggesting potential inventory growth. However, recovery remains gradual; if inventory stabilizes or increases, price growth will moderate and sales activity should improve, potentially unlocking pent-up demand for home furnishings and renovation products in 2026-2027.