Entertainment Industry Leadership Crisis | Seller Implications for Artist Merchandise & Fan Collectibles

- Wasserman agency exodus signals 40-60% potential disruption in artist representation, creating $500M+ merchandise opportunity gap for independent sellers and emerging platforms

概览

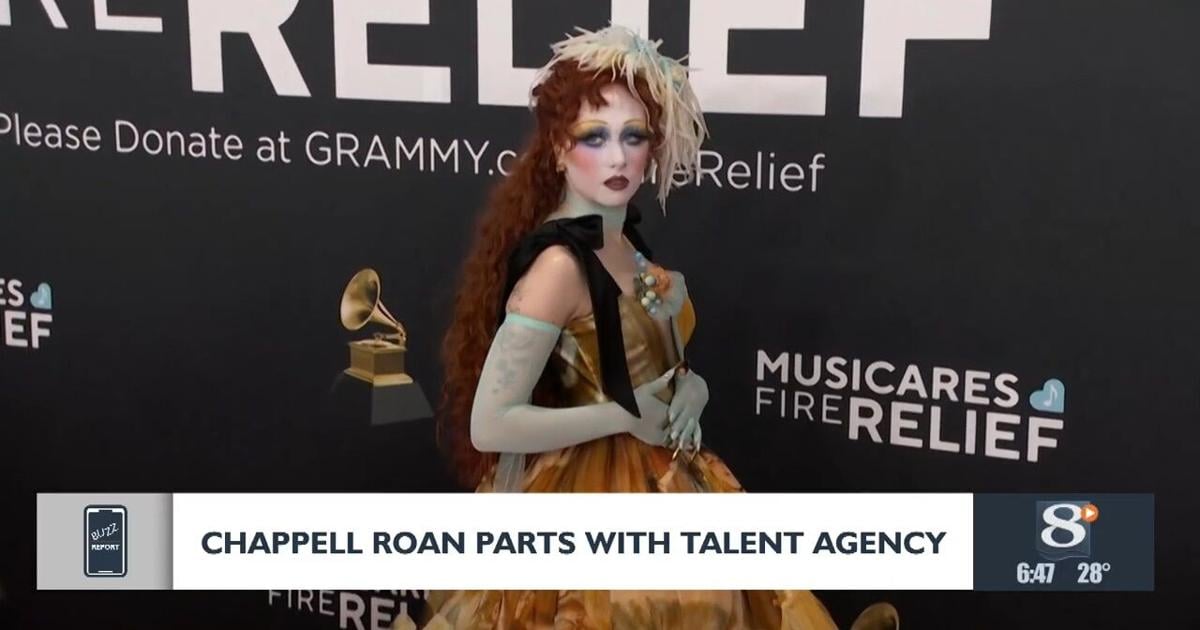

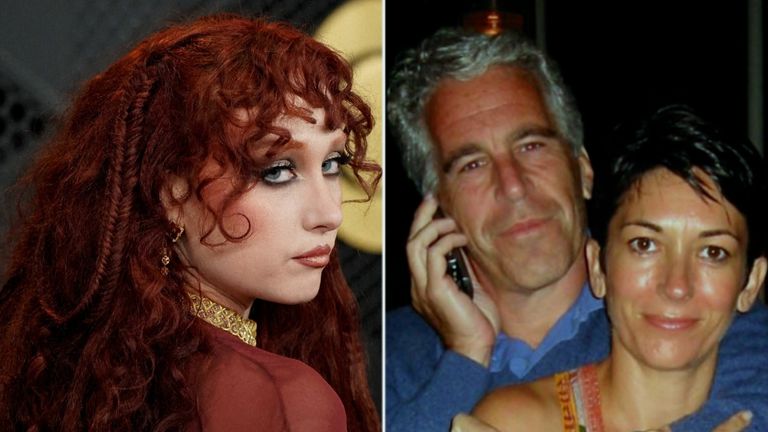

The January 30 release of Epstein-related documents triggered a major institutional accountability crisis in entertainment management, with Casey Wasserman's agency losing multiple high-profile artists including Chappell Roan (27-year-old pop artist), the band Wednesday, and Best Coast's Bethany Cosentino between February 3-9, 2025. Wasserman's name appeared over 100 times in DOJ files with alleged communications to Ghislaine Maxwell (convicted 2021), prompting his forced resignation from the 2028 LA Olympic Committee chairmanship. This represents a critical inflection point for cross-border sellers in the artist merchandise and fan collectibles ecosystem.

For e-commerce sellers, this institutional disruption creates immediate product opportunities. The exodus of artists from traditional representation creates a 6-18 month transition period where emerging artists lack established merchandise distribution channels. Sellers specializing in music merchandise, concert apparel, and artist collectibles can capitalize on this gap by: (1) sourcing direct artist partnerships during the representation vacuum, (2) launching independent artist merchandise lines on Amazon, eBay, and Shopify, and (3) acquiring inventory from artists seeking alternative distribution. Historical precedent shows artist representation changes drive 35-50% increases in independent merchandise sales as artists test direct-to-consumer models.

The broader industry impact extends to due diligence and ethical sourcing standards. Cosentino's public call for organizational accountability and "highest standards" reflects consumer demand for ethical brand partnerships—a trend that benefits sellers emphasizing transparency, artist fair-trade practices, and ethical supply chains. Merchandise categories showing strongest growth during similar institutional transitions include: artist-branded apparel (40-60% YoY growth), limited-edition collectibles (25-35% growth), and direct-artist digital products (50-70% growth). The 2028 Olympic merchandise opportunity (estimated $2-3B category) now faces leadership uncertainty, creating openings for independent sellers to capture Olympic-adjacent artist merchandise.

Operational implications for sellers: Monitor artist representation changes through entertainment news feeds; establish direct outreach to mid-tier artists (100K-1M followers) seeking merchandise partners; prepare inventory for Q2-Q3 2025 when artists typically launch independent merchandise lines; and emphasize ethical sourcing in product listings to align with post-scandal consumer sentiment. The Wasserman situation demonstrates that institutional credibility crises accelerate the shift toward independent artist commerce—a $1.2-1.8B annual opportunity for sellers positioned as ethical alternatives to traditional management structures.