Global Oil Markets Brace for Prolonged Price Compression and Strategic Realignment

- Unprecedented Supply Glut Reshapes Energy Sector Competitive Dynamics

Overview

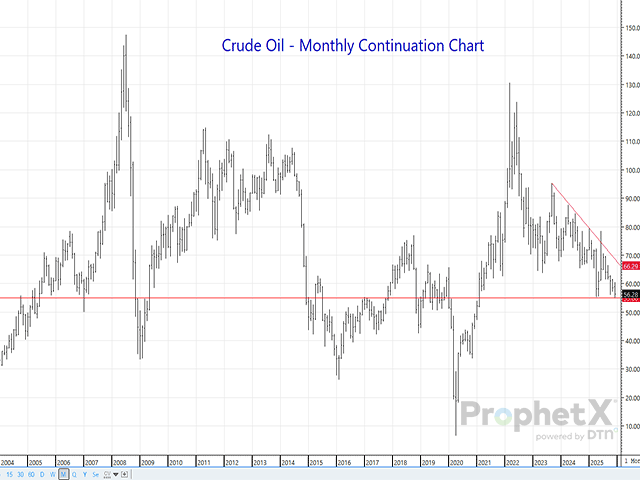

The global oil market is entering a critical inflection point characterized by structural oversupply and complex geopolitical recalibration. Brent and WTI crude prices are projected to experience sustained downward pressure, with major financial institutions like JP Morgan and Goldman Sachs anticipating an average of $56 and $52 per barrel respectively in 2026—signaling a profound market transformation.

The current market dynamics reveal a multi-dimensional supply challenge. Persistent Russian oil exports despite international sanctions have created an unexpected supply glut, with significant volumes struggling to find buyers. This oversupply is compounded by modest but consistent reductions in U.S. shale production—approximately 100,000 barrels daily—which paradoxically fail to meaningfully stabilize prices.

Geopolitical factors are adding layers of complexity to this market reconfiguration. Potential diplomatic developments surrounding the Ukraine conflict and emerging optimism about potential ceasefire negotiations are creating additional uncertainty. Analysts like Ole Hansen from Saxo Bank suggest traders will require concrete evidence of supply tightening before sentiment improves, likely not materializing until the second half of 2026.

Interestingly, Goldman Sachs has introduced a counterintuitive long-term perspective, projecting continued oil demand growth until 2040 and anticipating a market rebalancing by 2027. This projection suggests the current price compression is a transitional phase rather than a terminal decline. The bank points to reduced oil reserve life, maturing U.S. shale production, and solid demand growth as potential catalysts for future price recovery.

The current low price environment creates a high-stakes strategic dilemma for both U.S. shale producers and OPEC members. These price levels are fundamentally unsustainable, suggesting inevitable production responses aimed at price stabilization. Market participants are now closely monitoring supply discipline, geopolitical tensions, and demand recovery signals—each representing potential inflection points in this complex energy landscape.

For energy-dependent industries, this market contraction presents both significant challenges and nuanced opportunities. Transportation, manufacturing, and logistics sectors must rapidly adapt their strategic planning to navigate these volatile pricing dynamics, potentially leveraging reduced operational costs while preparing for future market shifts.