Japan's Monetary Revolution: The 0.75% Rate Hike That Rewrites Economic Playbooks

- A strategic pivot ending decades of ultra-low rates, reshaping global investment landscapes

Overview

The Bank of Japan's landmark decision to raise interest rates to 0.75% represents far more than a routine monetary adjustment—it's a seismic shift in Japan's economic strategy that will reverberate through global financial markets. After decades of near-zero rates, this move signals a profound transformation in how Japan manages economic recovery, inflation, and international competitiveness.

The rate increase emerges from a complex economic landscape: Japanese inflation has climbed to 3.00% annually, creating pressure to normalize monetary policy. Despite the country's economy contracting at a 2.3% annual rate, the BOJ is signaling confidence in a gradual economic restructuring. Prime Minister Sanae Takaichi's accompanying 117 billion stimulus package demonstrates a synchronized approach, targeting key sectors like semiconductors and military investments while balancing economic growth.

For global investors, this represents a critical inflection point. The USD/JPY exchange rate is already showing emerging bearish momentum, with technical indicators suggesting potential downward movement. The narrowing interest rate differentials could make yen-denominated investments increasingly attractive, potentially driving stronger demand for the Japanese currency. This shift disrupts long-standing carry trade strategies where investors borrowed in yen to invest elsewhere.

The technical precision of this monetary adjustment is noteworthy. BOJ Governor Kazuo Ueda has maintained a cautious approach, with markets currently pricing only one potential additional rate hike to the lower end of a 1.0 to 2.5% neutral rate range. This measured strategy reflects Japan's commitment to controlled, strategic economic transformation.

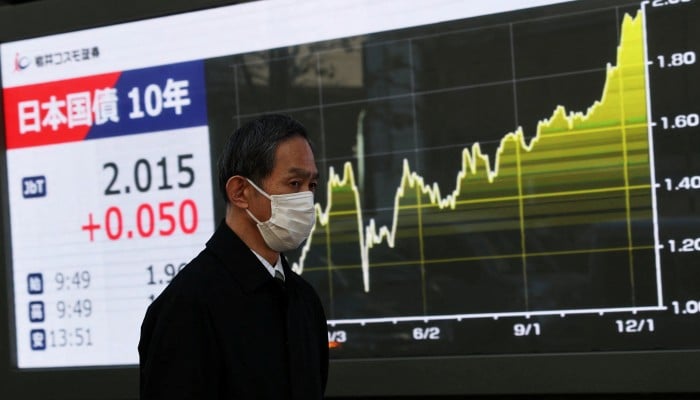

Critically, this move isn't just about interest rates—it's about restructuring Japan's economic identity. After decades of economic stagnation, the country is signaling its readiness to embrace more dynamic monetary management. The bond market's response, pushing 10-year yields to 2.015% (a level unseen since August 1999), symbolizes this fundamental shift.

For cross-border businesses and investors, the implications are profound. Technology sectors, particularly semiconductors, are showing resilience, suggesting potential stability in investment opportunities. The rate hike creates a new strategic landscape where understanding nuanced monetary shifts becomes crucial for competitive positioning.