Federal Reserve's Inflation Puzzle: Navigating Uncertain Economic Signals

- Decoding the Complex Landscape of Monetary Policy and Market Expectations

Overview

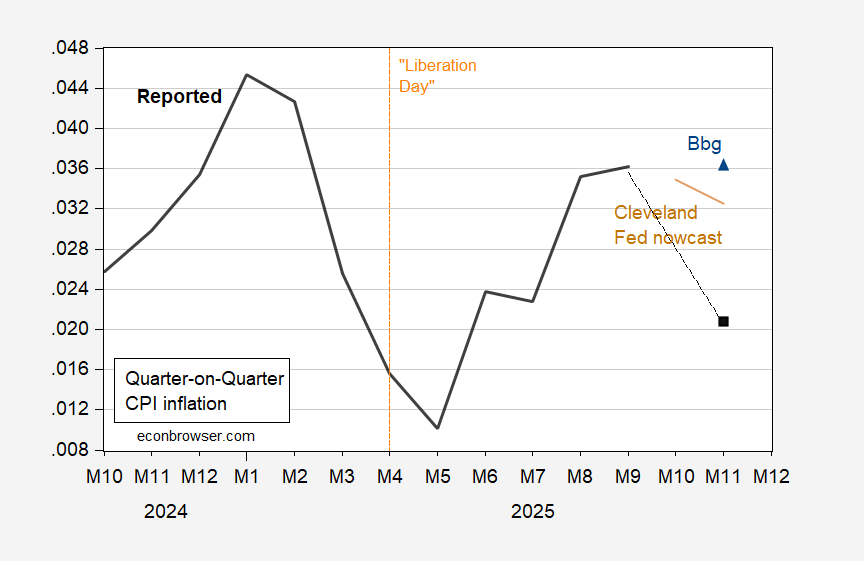

The current economic landscape reveals a nuanced monetary policy environment where traditional inflation indicators are becoming increasingly unreliable. The U.S. Bureau of Labor Statistics' November inflation report has exposed critical vulnerabilities in economic data collection and interpretation, sending ripple effects through financial markets and policy-making circles.

Methodological Distortions in Inflation Reporting have emerged as a key concern. The BLS's inability to collect comprehensive price data during the October-November period led to statistical assumptions that effectively neutralized significant inflation categories. Most notably, housing costs, which typically represent over 40% of core Consumer Price Index (CPI), were essentially treated as static—a methodology that top economists like Diane Swonk and Joseph Brusuelas have roundly criticized.

The market's response reflects a growing uncertainty in economic forecasting. While the headline inflation figure of 2.7% year-over-year might suggest cooling pressures, the underlying data tells a more complex story. Unexpected anomalies—such as gasoline price increases and sudden daycare cost drops—underscore the fragility of current economic models. Wall Street is simultaneously growing more optimistic about potential Federal Reserve rate cuts, with JPMorgan analysts projecting the S&P 500 could reach 8,000 by 2026.

Strategic Implications extend beyond mere numbers. The potential rate cuts could reshape market dynamics, potentially expanding leadership beyond technology stocks into cyclical sectors like retail, automotive, and travel. For cross-border businesses, this signals a critical moment to reassess investment strategies, as changes in interest rates can dramatically affect operational costs and market access.

The Treasury market's reaction further illuminates this complexity. The first weekly gain since November, driven by cool inflation data and rising jobless rates, suggests the Federal Reserve might have more monetary policy flexibility than previously anticipated. Core inflation has reached its slowest annual pace since early 2021, creating a nuanced economic environment where traditional predictive models are being challenged.

Investors and businesses must approach these developments with sophisticated caution. The convergence of slowing inflation and rising unemployment provides an intricate economic picture that defies simplistic interpretation.