Treasury Yields Navigate Uncertain Waters Amid Quirky Inflation Reporting

- Data Inconsistencies Reveal Critical Challenges in Economic Reporting Methodology

Overview

The November inflation report has unveiled a complex financial landscape where data integrity and economic reporting are under unprecedented scrutiny. At the heart of this narrative is a 2.7% inflation rate that appears deceptively straightforward but carries significant methodological uncertainties triggered by recent government shutdown challenges.

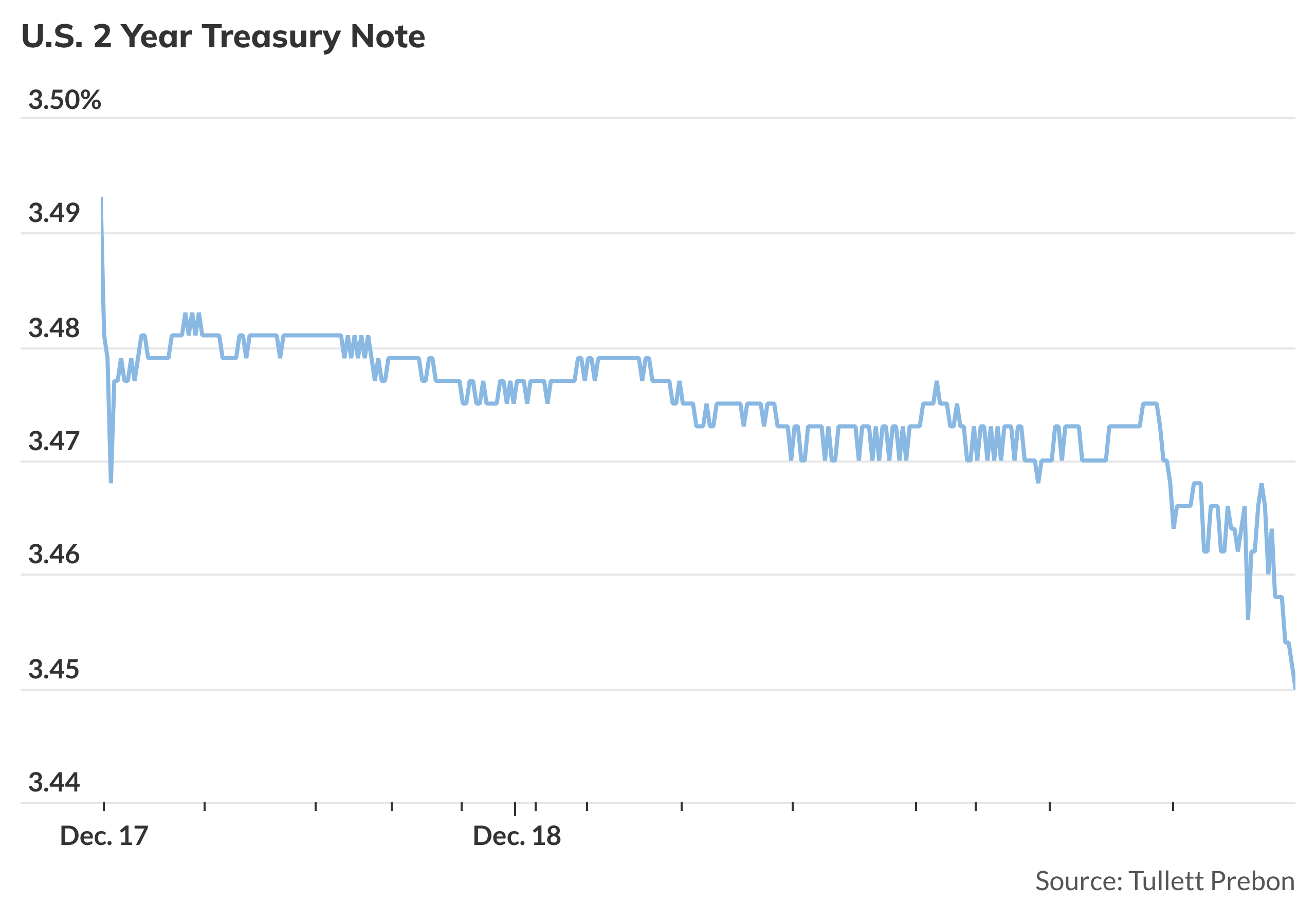

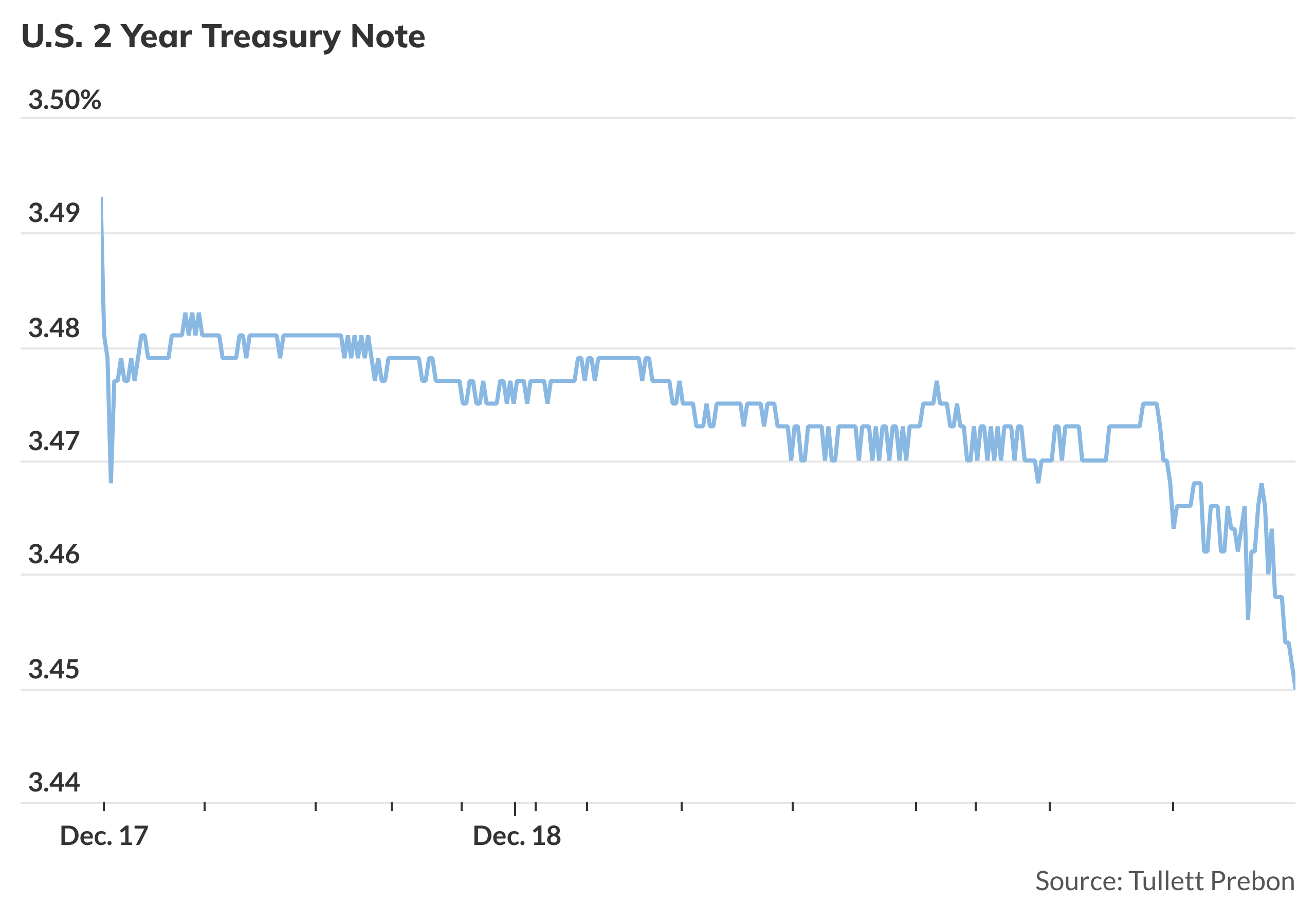

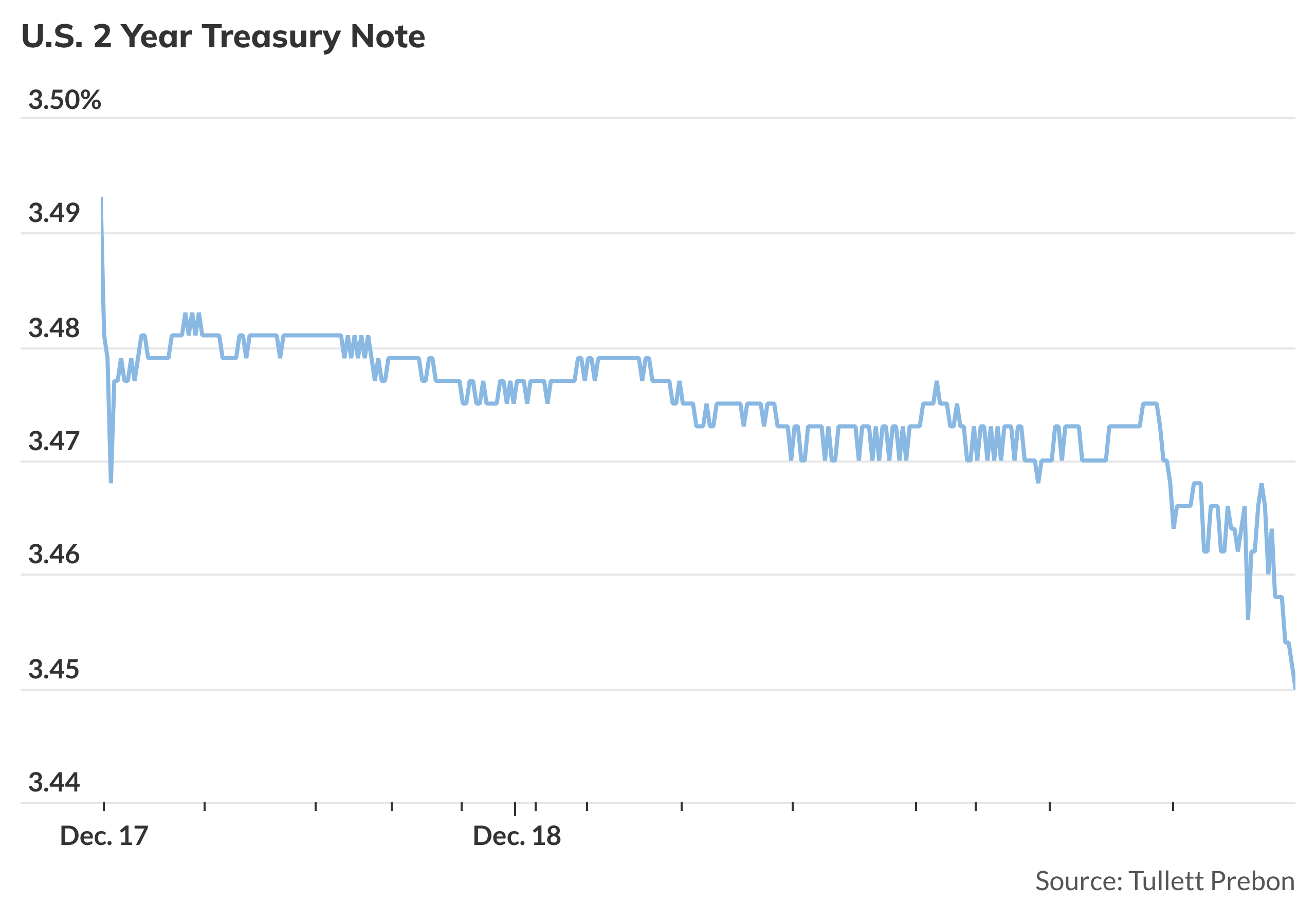

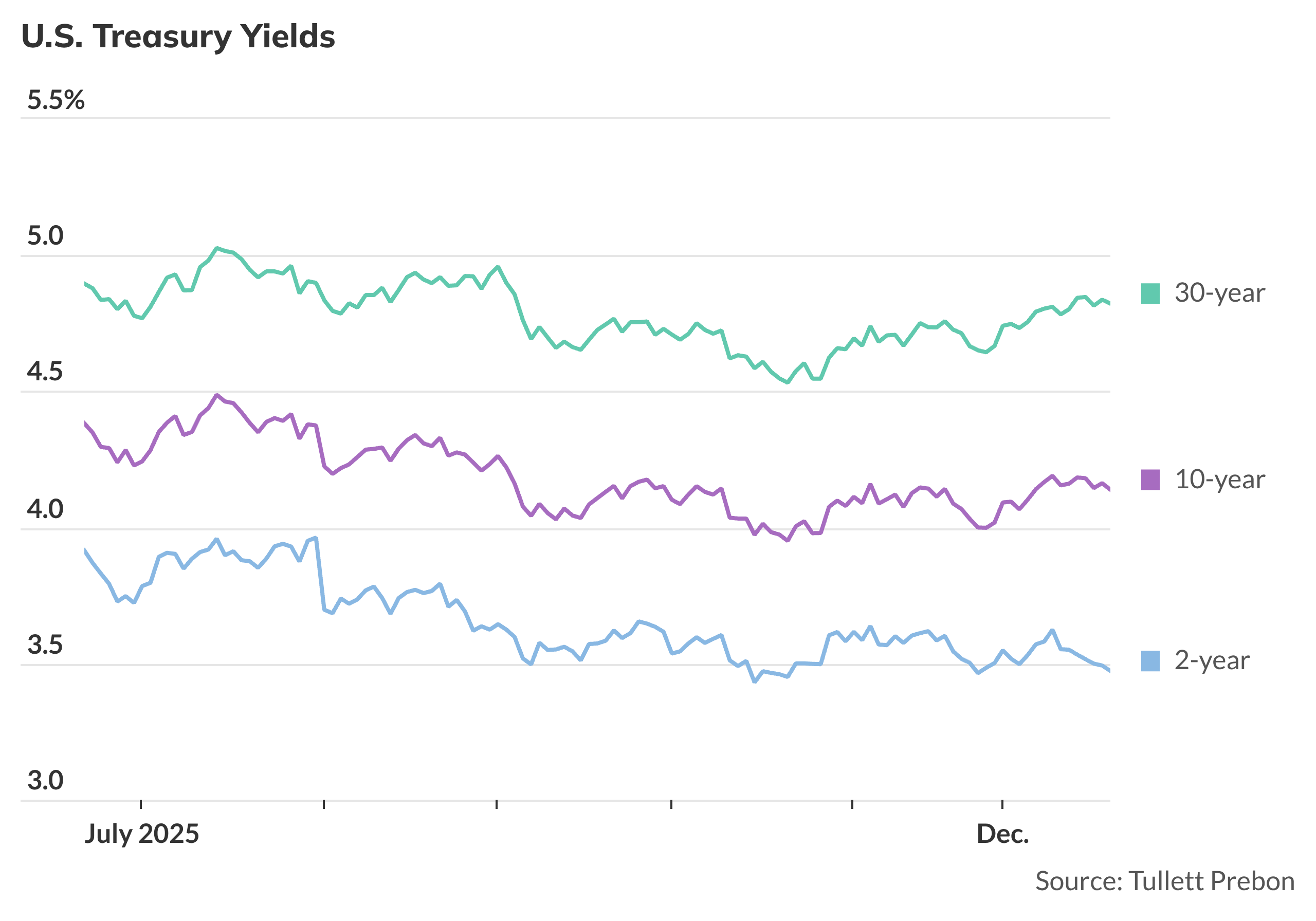

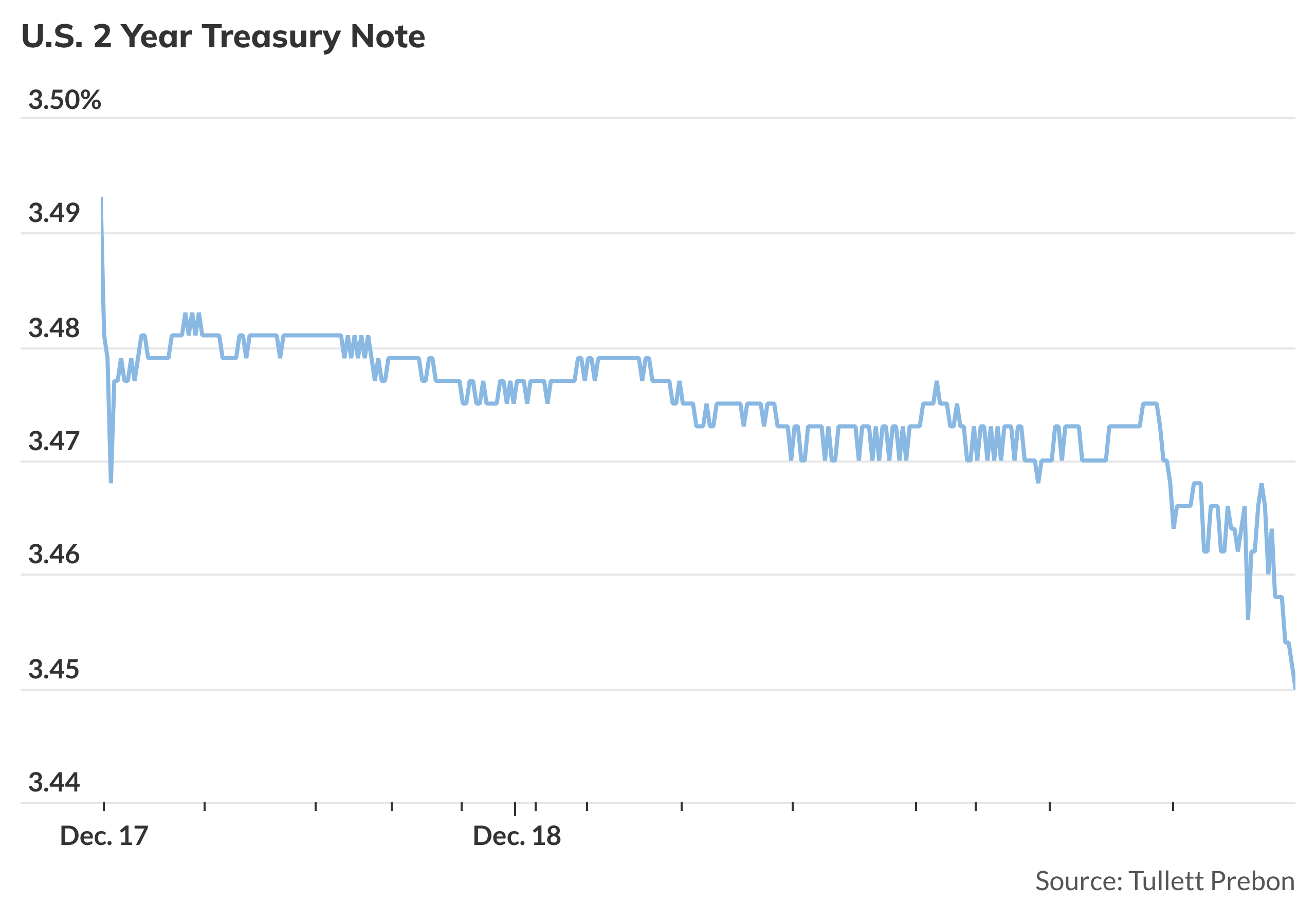

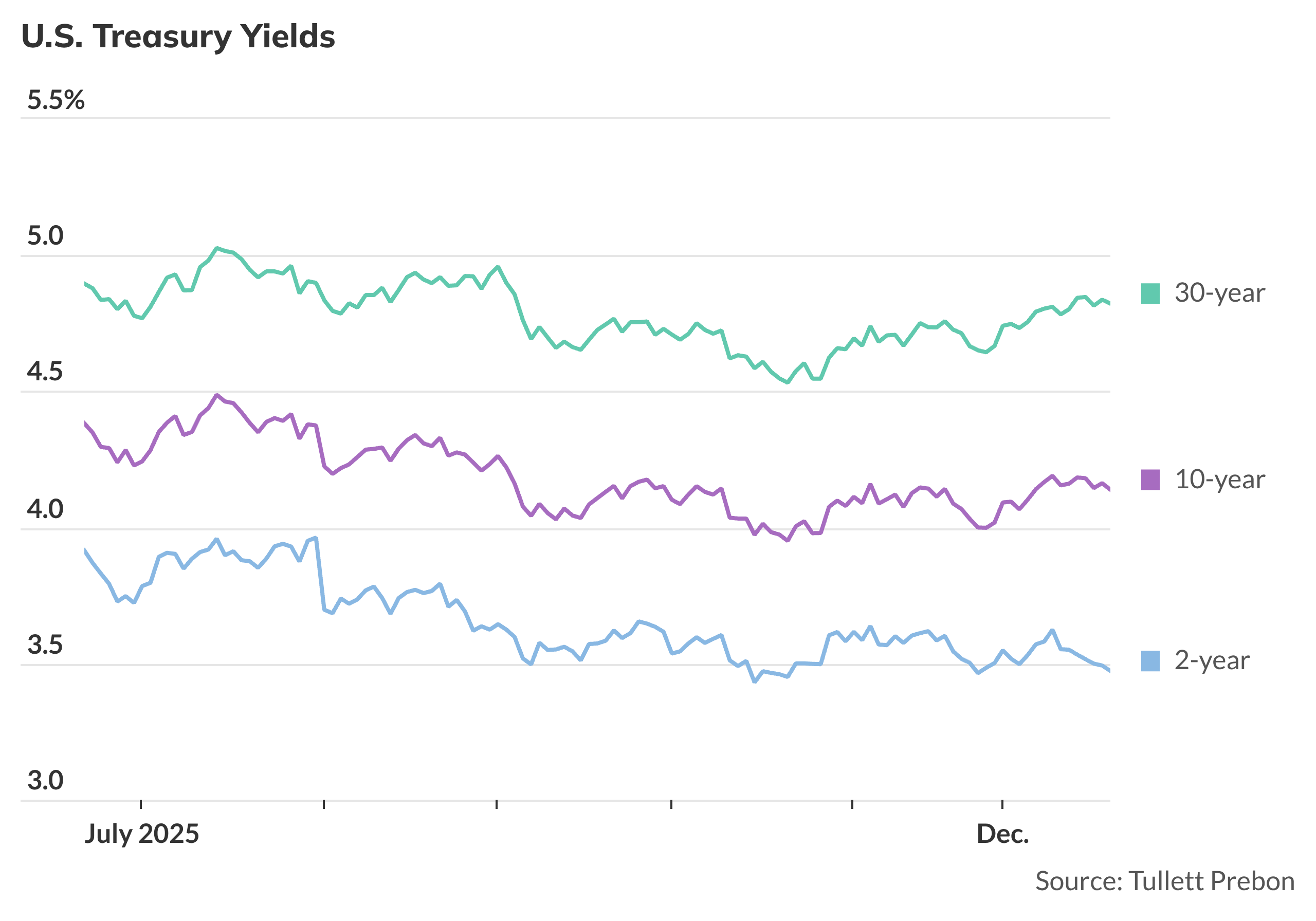

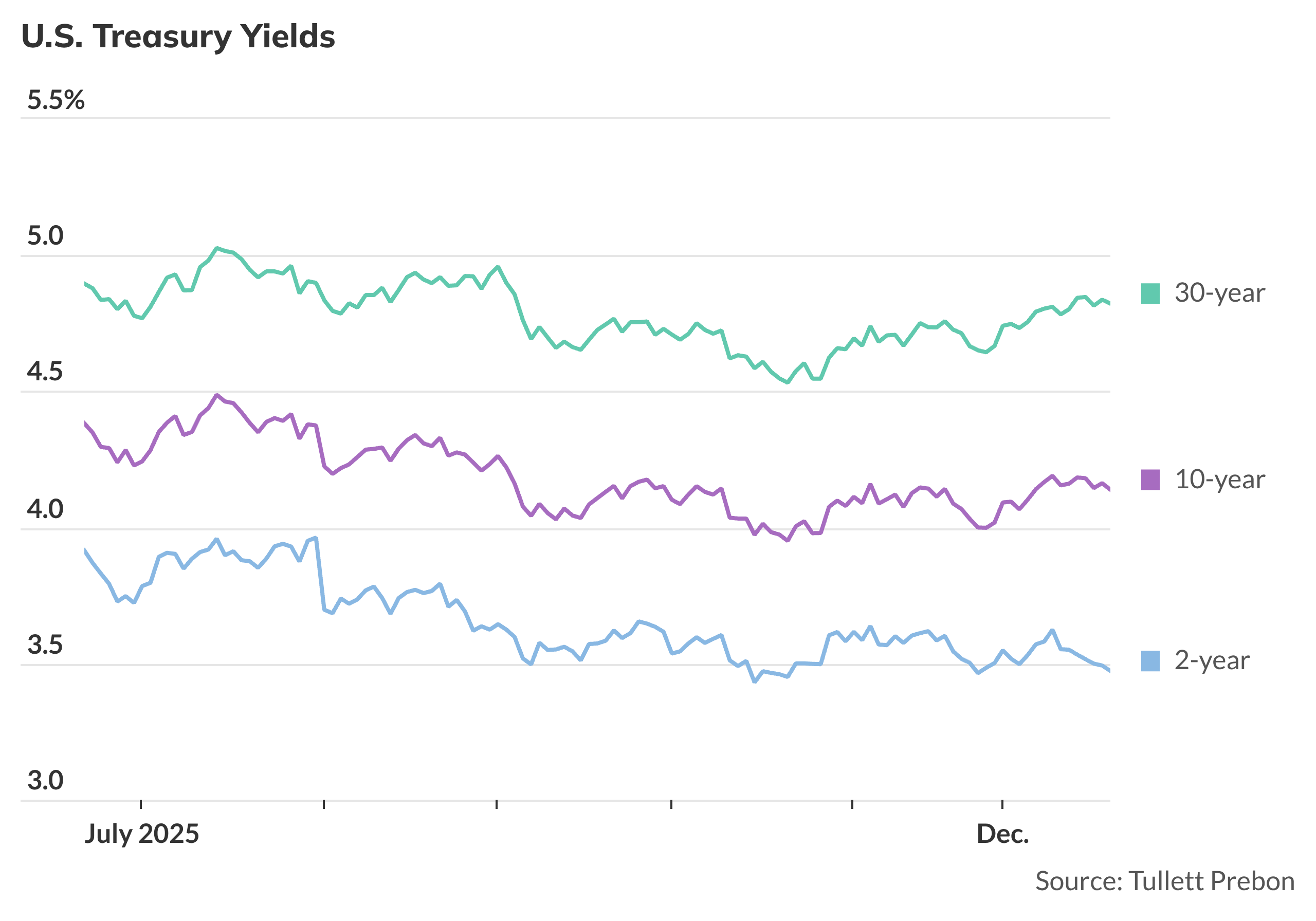

Treasury market reactions demonstrate remarkable restraint, with yields experiencing minimal fluctuations despite the provocative data. The 10-year Treasury yield's subtle movements—rising slightly from 4.15% to 4.117%—signal a sophisticated investor response that goes beyond surface-level headline numbers. Traders are displaying remarkable nuance, recognizing that the current inflation report contains more questions than answers.

The most critical insight emerges from the missing October housing inflation data, a gap that fundamentally compromises the report's representativeness. Economists are essentially working with an incomplete puzzle, cautioning against drawing definitive conclusions. This methodological challenge reveals a deeper systemic vulnerability: how administrative disruptions can materially impact economic analysis.

Interestingly, the Federal Reserve rate cut speculation continues, with traders now pricing a 56.8% chance of a March reduction. This forward-looking perspective suggests that market participants are looking beyond the current data inconsistencies, anticipating potential monetary policy adjustments. The muted market response indicates a sophisticated understanding that temporary reporting challenges do not necessarily negate underlying economic trends.

The broader implication is profound: economic reporting is not just about numbers, but about the robust systems and methodologies that generate those numbers. When those systems are disrupted—even temporarily—the ripple effects can create significant interpretative challenges for policymakers, investors, and analysts alike.