Gold's Debasement Trade: How Precious Metals Are Signaling a Macro Economic Transformation

- Emerging Market Central Banks Pivot Away from Dollar Amid Fiscal Uncertainty

Overview

Precious metals are emerging as a critical financial barometer, revealing deep structural shifts in global monetary policy and investment strategies. The current gold market isn't just experiencing a price surge; it's signaling a profound recalibration of economic power dynamics driven by unprecedented fiscal and monetary conditions.

Spot gold trading near $4,330 per ounce represents more than a mere price point—it's a strategic response to complex macroeconomic signals. The core US Consumer Price Index (CPI) rising at its slowest pace since early 2021 has created a nuanced investment landscape where traditional inflation hedges are being reimagined. Societe Generale's Albert Edwards provocatively frames this as a potential "debasement trade" reminiscent of the 1970s, suggesting we're witnessing more than a cyclical trend.

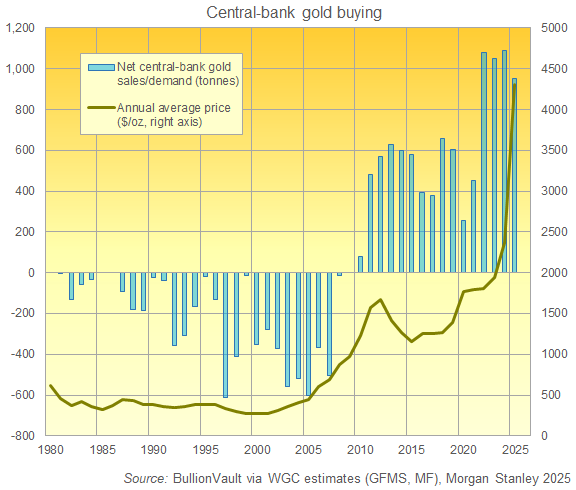

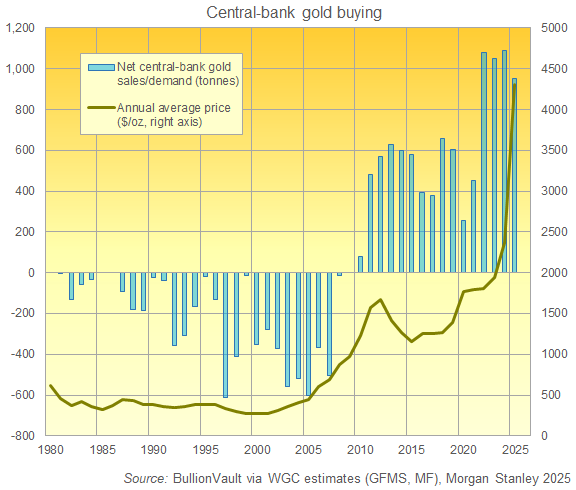

The most compelling narrative emerges from emerging market central banks pivoting away from the US dollar. Triggered by geopolitical events like President Biden's 2022 freeze of Russian forex reserves, these institutions are strategically diversifying their reserves. This isn't just a defensive maneuver but a calculated long-term strategy challenging dollar hegemony. The absence of typical "irrational exuberance" in the current gold market further distinguishes this moment—suggesting a methodical, structural transformation rather than a speculative bubble.

Critically, the precious metals surge extends beyond gold. Silver's 126% year-to-date climb and copper reaching all-time highs indicate a broader commodities revaluation. This suggests investors are hedging against potential monetary policy uncertainties, with central banks signaling potential quantitative easing and yield curve control strategies.

Investors and financial strategists should pay close attention: This isn't just about gold prices, but about fundamental shifts in global financial architecture. The current trajectory suggests a potential long-term realignment of currency reserves, investment strategies, and geopolitical economic power.