Media Meets Fusion Energy Strategic Pivot Signals Tech Convergence

- Cross-sector merger reveals emerging opportunities in AI infrastructure and clean energy

Overview

The Trump Media and TAE Technologies merger represents a groundbreaking strategic repositioning that transcends traditional industry boundaries, signaling a profound shift in how technology, media, and energy sectors intersect. At its core, this $6 billion transaction is not just a corporate combination, but a sophisticated response to the escalating energy demands of artificial intelligence infrastructure.

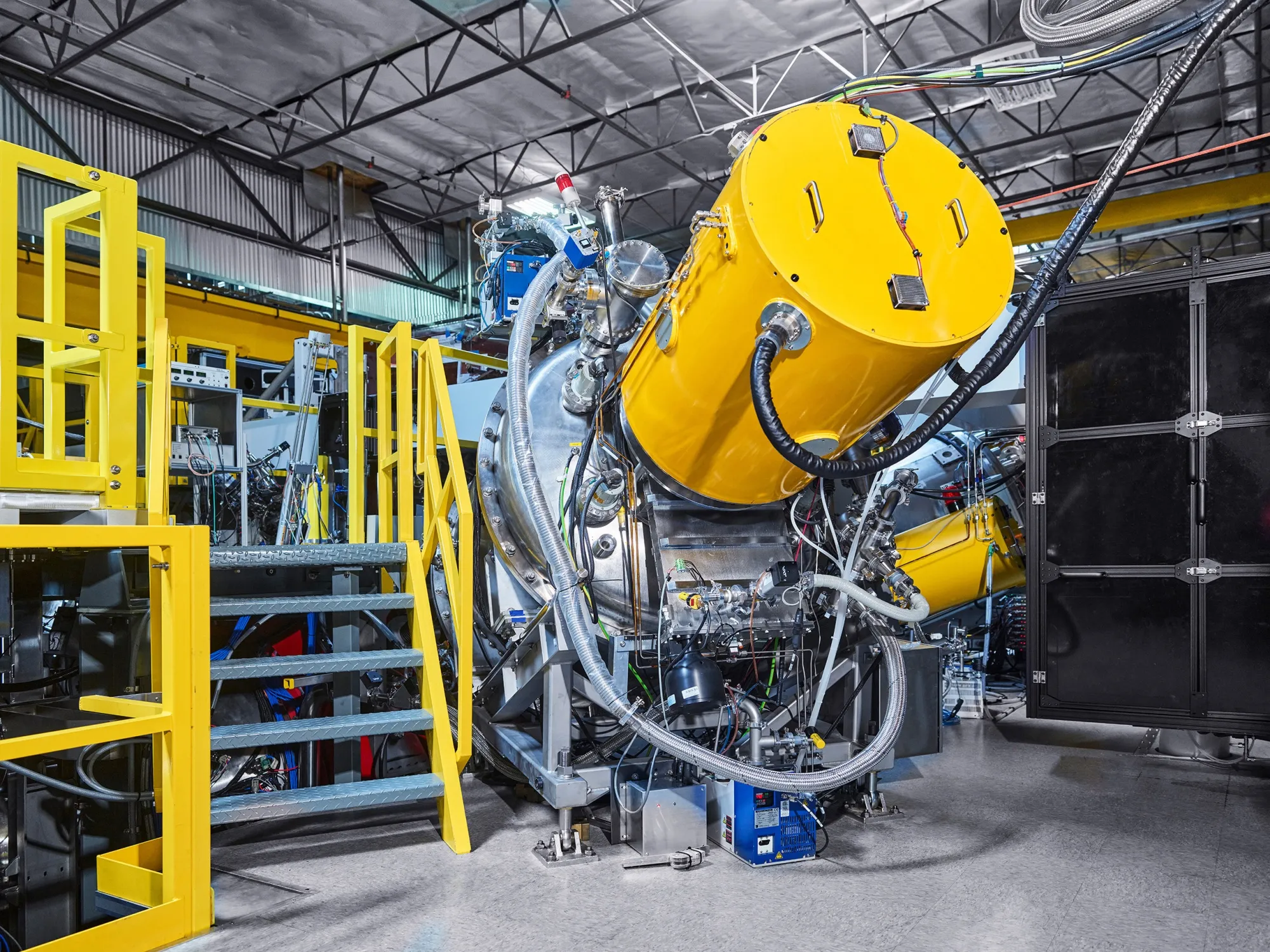

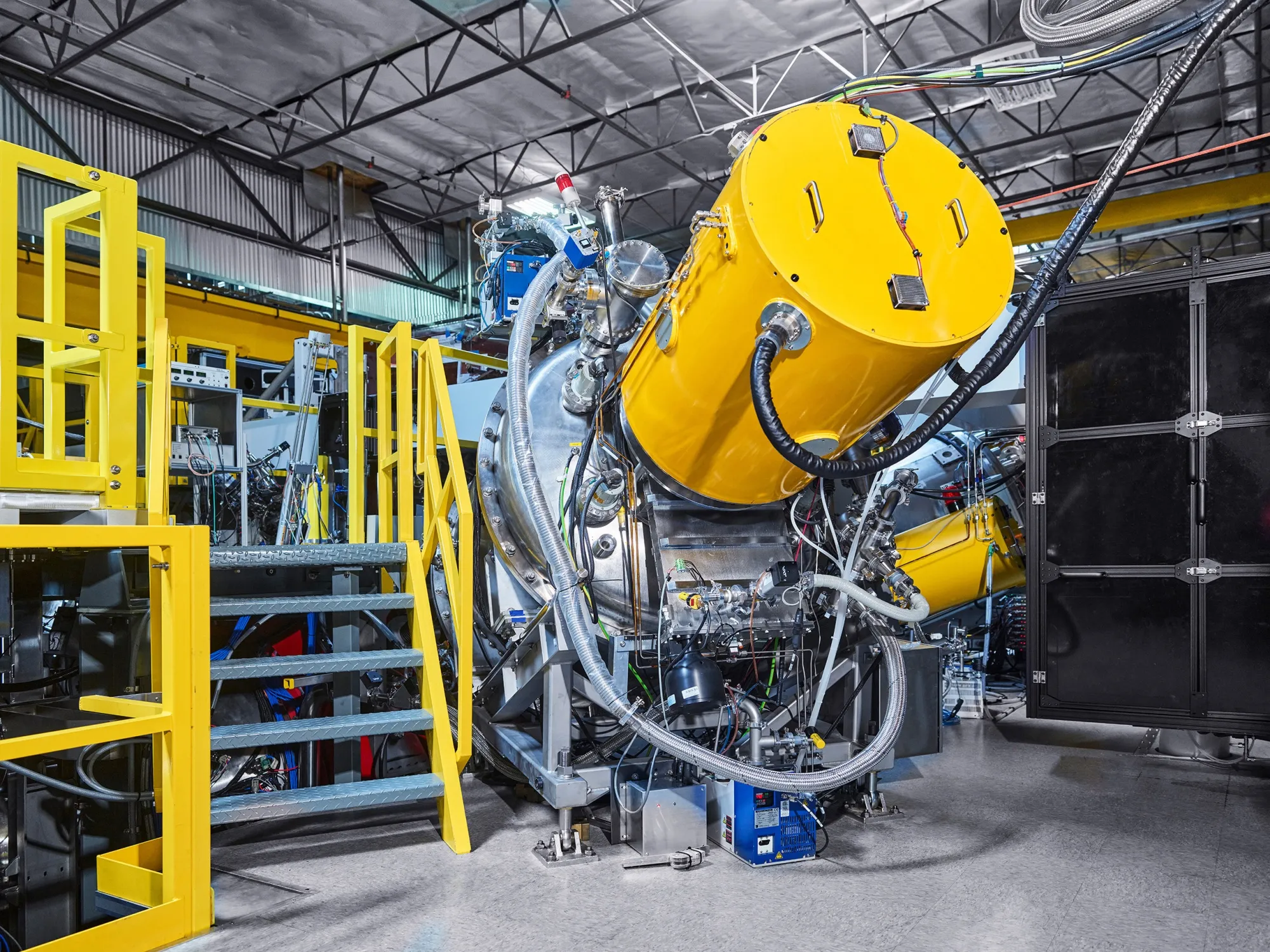

Fusion energy emerges as the critical technological bridge in this merger, positioning the combined entity at the cutting edge of computational power solutions. By injecting $300 million into TAE Technologies, Trump Media is making a calculated bet on next-generation energy technology that could revolutionize AI's computational capabilities. The partnership aims to develop the world's first utility-scale fusion power plant by 2031, transforming what initially appears to be an unusual cross-sector merger into a strategic long-term infrastructure play.

The merger reveals several critical insights for technology and energy strategists. First, it demonstrates that media platforms are no longer confined to content creation but can serve as strategic investment vehicles for emerging technologies. Second, the deal highlights the growing interdependence between computational power, energy infrastructure, and media platforms. The involvement of an Alphabet-backed fusion research firm suggests this is not a speculative venture, but a carefully calculated technological convergence.

Notably, the transaction occurs against a backdrop of increasing AI energy demands and the complex challenge of developing sustainable, scalable power generation. By positioning themselves at this technological intersection, the merged entity could potentially create a new model of technology development that breaks traditional sectoral boundaries. The $6 billion valuation and the involvement of sophisticated investors signal market confidence in this unconventional approach.

However, potential risks remain. TAE Technologies' history of unpaid bills and Trump Media's market volatility suggest this merger is not without financial complexity. Investors and industry observers will closely watch how the combined entity navigates these challenges while pursuing its ambitious fusion energy goals.