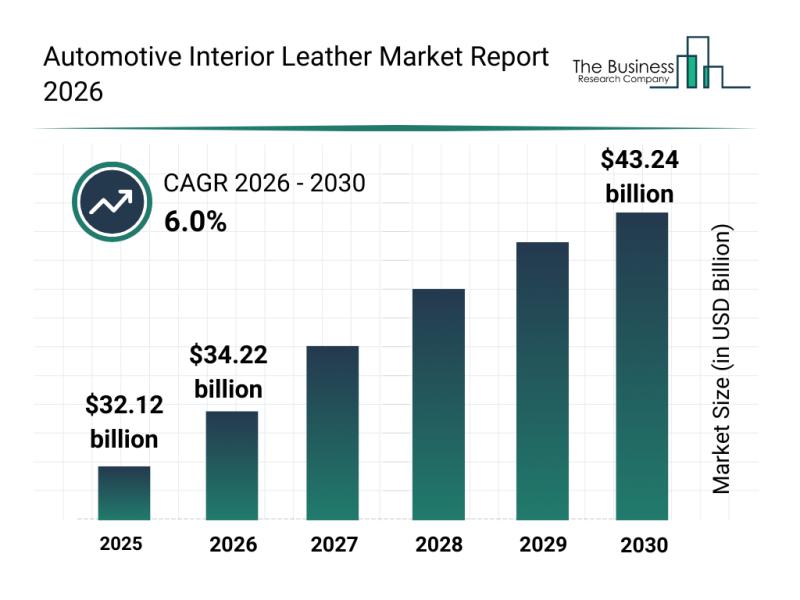

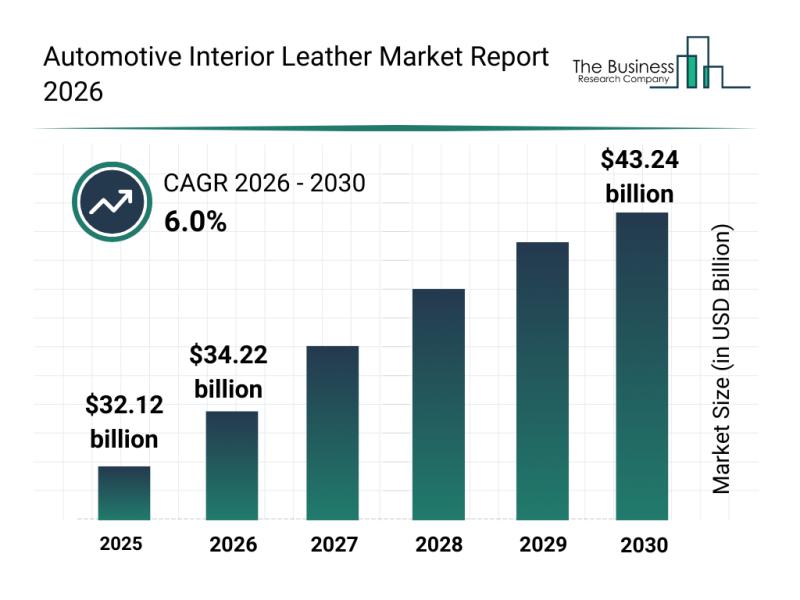

$43.24B Automotive Leather Market Boom | Vegan & Bio-Based Materials Drive 6% Growth Through 2030

- Sustainable leather alternatives create $8.6B+ new market opportunity for cross-border sellers; Hyundai's bio-based innovation signals regulatory shift affecting 50K+ automotive aftermarket suppliers globally

Overview

The global automotive interior leather market is experiencing a transformative shift toward sustainability, with projections reaching $43.24 billion by 2030 at a 6.0% compound annual growth rate (CAGR). This expansion directly impacts cross-border e-commerce sellers through emerging product categories, supply chain consolidation, and regulatory compliance requirements. The market is being reshaped by four critical forces: stricter sustainable material regulations, electric vehicle interior upgrades, vegan leather adoption, and smart trim technology integration.

For cross-border sellers, this represents a $8.6B+ incremental market opportunity (calculated from 2030 projection minus current baseline). The August 2023 acquisition of Roadwire by Katzkin signals industry consolidation, indicating that smaller suppliers must differentiate through specialization. More significantly, Hyundai's August 2025 bio-based faux leather project using wheat, soy, and corn proteins demonstrates that major OEMs are actively developing plant-based alternatives—creating urgent demand for compatible aftermarket products, customization services, and material suppliers on Amazon, eBay, and specialty automotive marketplaces.

Seller segments most affected include: (1) Automotive aftermarket retailers selling seat covers, upholstery, and interior trim kits—who must pivot inventory toward synthetic and vegan leather options; (2) Material suppliers and wholesalers sourcing polyurethane, PVC, biodegradable variants, and microfiber materials for resale; (3) Customization service providers offering premium interior upgrades for luxury and mid-segment vehicles; (4) Sustainability-focused brands positioned to capture eco-conscious consumers willing to pay 15-25% premiums for certified vegan leather products.

The regulatory environment is tightening globally. Stricter sustainability regulations are forcing traditional leather suppliers to invest in alternative materials, creating supply chain gaps that nimble e-commerce sellers can exploit. The shift toward lightweight interior components for electric vehicles adds another layer—EV manufacturers prioritize weight reduction for battery efficiency, creating demand for lighter synthetic materials that cross-border sellers can source from Asia-Pacific manufacturers and distribute globally.

Key market segments by application: seats (highest volume), center stack, upholstery, and door panels. The convergence of consumer demand for eco-friendly options, regulatory pressure, and technological advancement in smart trim components (sensors, electronics) indicates sustained growth potential through 2030. Sellers who establish supply chains for bio-based and vegan leather alternatives now will capture first-mover advantage as OEM adoption accelerates.