Gold Price Volatility & Metal Costs Surge | Critical Supply Chain Impact for E-Commerce Sellers

- Chinese speculative trading drives gold to $5,070/oz; metal-dependent sellers face 8-15% cost increases and inventory valuation challenges through Q2 2026

)

)

Overview

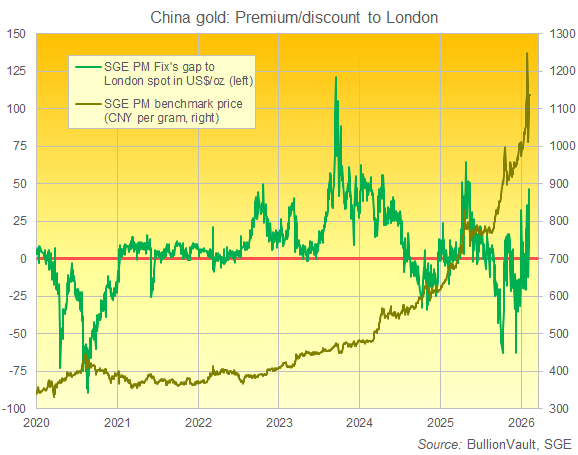

Chinese financial market dynamics are creating unprecedented commodity price volatility that directly impacts cross-border e-commerce sellers across multiple product categories. Treasury Secretary Scott Bessent publicly identified "unruly" Chinese speculative trading as the primary driver of gold price swings on February 8, 2026, with gold reaching approximately $5,070 per ounce—a significant spike driven by both institutional speculation and retail household investors (colloquially known as "Aunties") purchasing precious metals as economic hedges. The underlying cause: China's monetary stimulus has flooded financial markets with liquidity that preferentially flows into commodity speculation rather than productive economic investment, creating a systemic risk environment where Chinese regulators have implemented tighter margin requirements to control excessive leverage.

For cross-border e-commerce sellers, this creates a three-tier impact structure. First, sellers in precious metals and jewelry categories (HS codes 7106-7118) face direct sourcing cost pressures. Gold jewelry sellers relying on Chinese suppliers are experiencing margin compression of 8-15% as raw material costs surge and Chinese manufacturers face tighter credit conditions. Inventory valuation becomes critical—sellers holding gold-denominated stock face potential write-downs if prices correct sharply, while those with pre-positioned inventory at lower costs gain temporary competitive advantages. Second, sellers in metal-dependent manufacturing categories (electronics, machinery, packaging, tools) face indirect cost pressures. Copper, silver, and base metals reached record highs in January 2026, directly increasing production costs for electronics sellers (HS 8471-8517), machinery manufacturers (HS 8401-8483), and packaging suppliers. Third, the volatility itself creates operational uncertainty—supply chain planning becomes difficult when raw material costs fluctuate 5-8% weekly, forcing sellers to either absorb costs or implement dynamic pricing strategies that risk Buy Box loss on Amazon or competitive disadvantage on eBay.

The timing window is critical: February-June 2026 represents peak exposure. Chinese regulatory tightening (increased margin requirements) will eventually reduce speculative activity, but this transition period creates both risks and opportunities. Sellers should immediately audit their metal-dependent inventory and cost structures. For jewelry sellers, this is the moment to lock in supplier contracts at current rates before further price appreciation, or alternatively, to shift sourcing to non-Chinese suppliers (Vietnam, India, Thailand) where metal costs may be lower. For electronics and machinery sellers, consider hedging strategies through commodity futures or supplier contracts with price caps. The underlying economic weakness in China's real economy (capital flowing to speculation rather than productive investment) suggests this volatility may persist through Q2 2026 before regulatory controls take full effect. Sellers should monitor Chinese futures market activity weekly and adjust pricing strategies accordingly—those who implement dynamic pricing tied to commodity indices will maintain margins while competitors suffer compression.