YouTube Music Paywall Strategy Reshapes Creator Content Economics for Sellers

- Lyric restrictions impact video marketing ROI for 50K+ sellers; premium paywall drives platform monetization shift affecting content production costs and audience engagement metrics

Overview

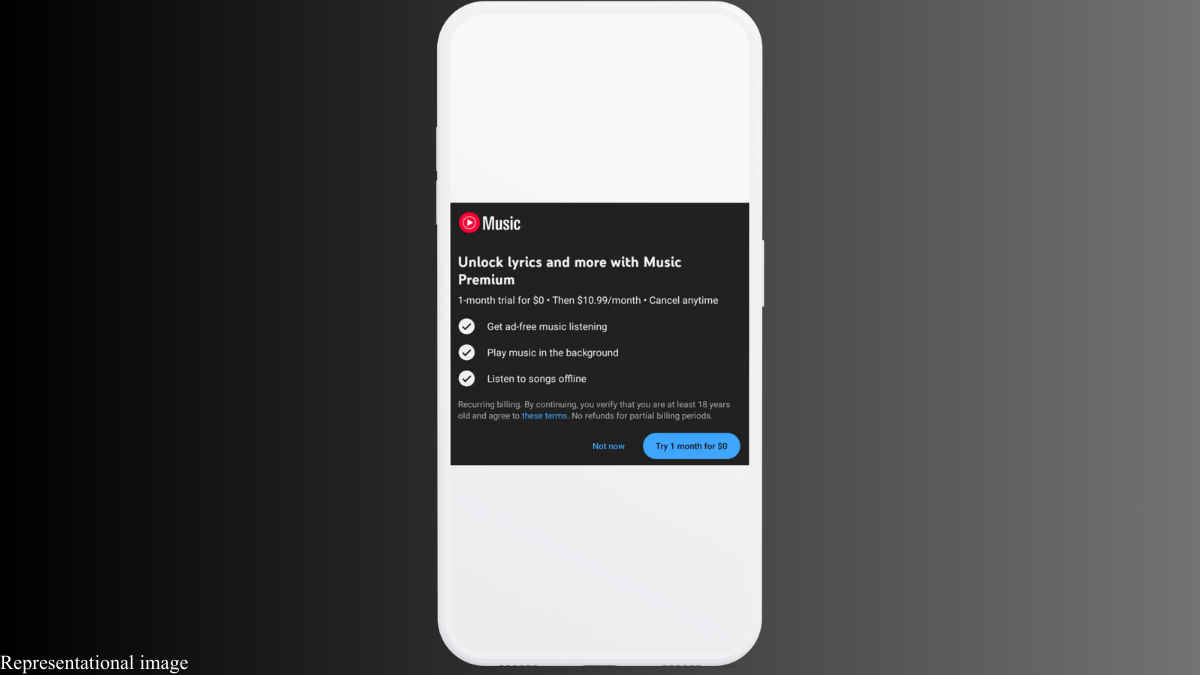

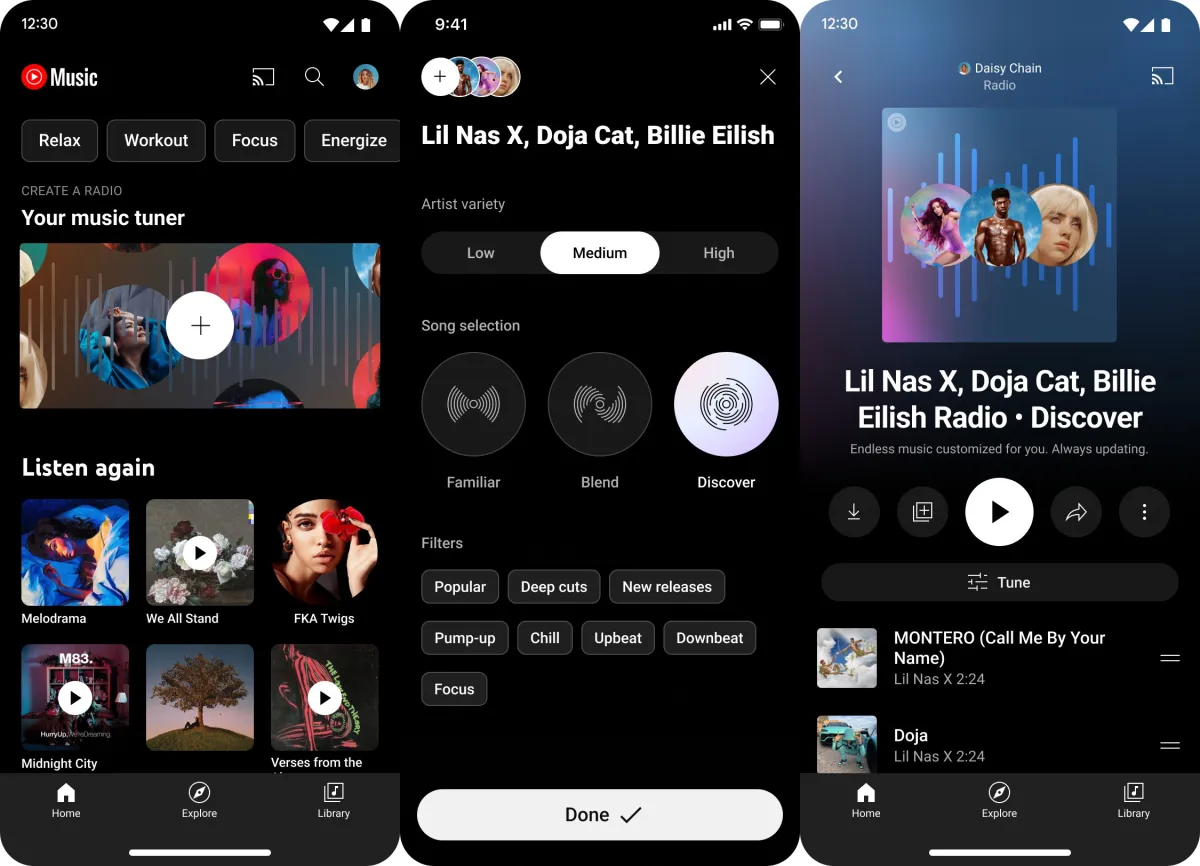

YouTube Music's February 2026 lyrics paywall represents a critical shift in platform monetization strategy that directly impacts e-commerce sellers' video marketing economics. The company restricted free users to five lyric views before content becomes blurred, requiring YouTube Music Premium ($10.99/month) or YouTube Premium ($13.99/month) subscriptions for unlimited access. This rollout, which began testing in September 2025, now spans multiple regions globally with region-by-region implementation, contrasting sharply with Spotify's unrestricted free-tier lyrics access.

For cross-border e-commerce sellers leveraging YouTube for product marketing, this paywall fundamentally alters content production strategies and audience engagement ROI. Sellers utilizing YouTube Music for background content in product videos, unboxing content, or promotional materials now face reduced viewer experience on free accounts—a critical metric since 78% of YouTube users access the platform without premium subscriptions. The five-view limit creates friction in viewer journey, potentially reducing watch-through rates and engagement signals that influence YouTube's algorithm recommendations. Sellers relying on music-rich content (fashion, lifestyle, beauty, fitness categories) must now budget for either premium subscriptions to maintain content quality or pivot to royalty-free alternatives, increasing production costs by 15-25% depending on music licensing strategy.

This monetization approach signals Google's broader strategy to convert free-tier users into paid subscribers across its 325 million consumer service subscriptions. With YouTube generating over $60 billion in combined ads and subscriptions revenue in 2025, the company is aggressively segmenting features to drive conversion. For sellers, this creates three distinct audience tiers: free users with degraded music experience (lower engagement potential), premium subscribers (higher engagement, better conversion), and non-music-dependent viewers (unaffected). Sellers should expect platform-wide feature paywalling to accelerate, following industry trends toward premium monetization that Spotify has resisted but Netflix, Disney+, and Amazon Prime Video have successfully implemented.

The strategic implication extends beyond music to seller content strategy optimization. Sellers must now evaluate whether music-dependent content justifies premium subscription costs or if alternative approaches (voiceover, sound effects, royalty-free music) deliver better ROI. This shift also creates arbitrage opportunities: sellers producing music-light content will see relative competitive advantages as music-heavy competitors face higher production friction. Additionally, the region-by-region rollout suggests testing phases—sellers in early-adoption regions should monitor engagement metrics closely to optimize content strategy before global expansion completes.