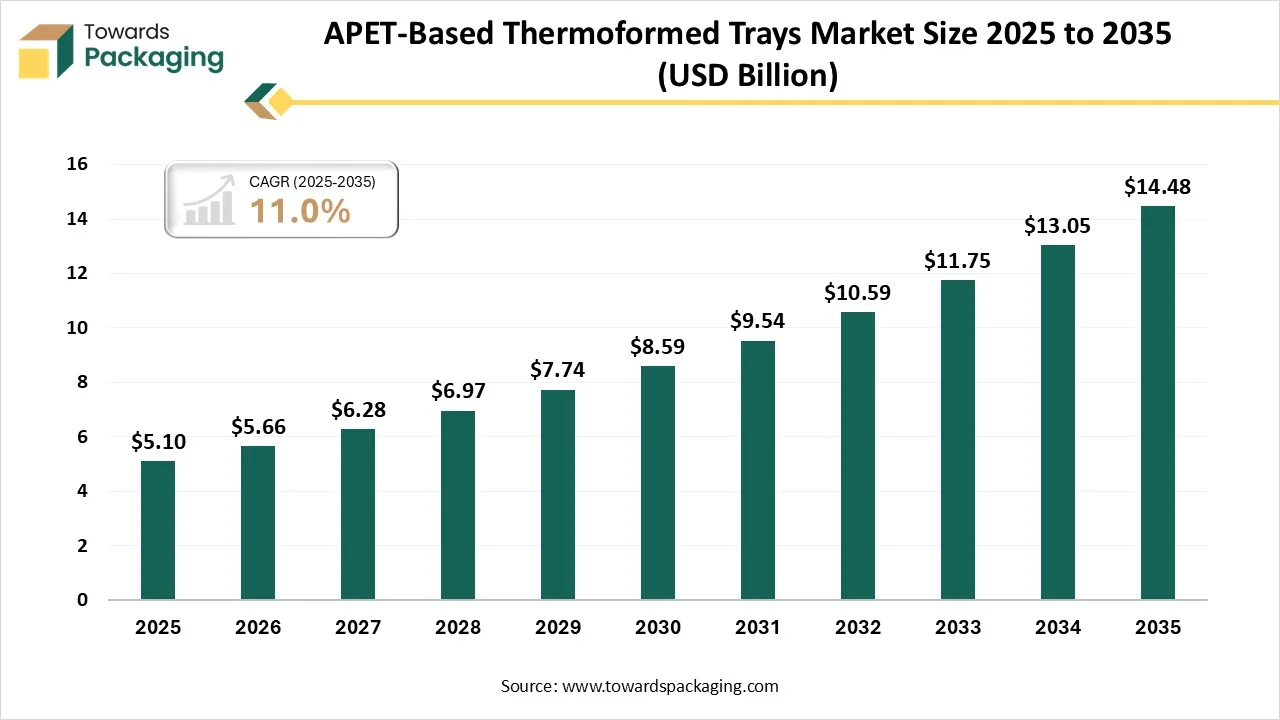

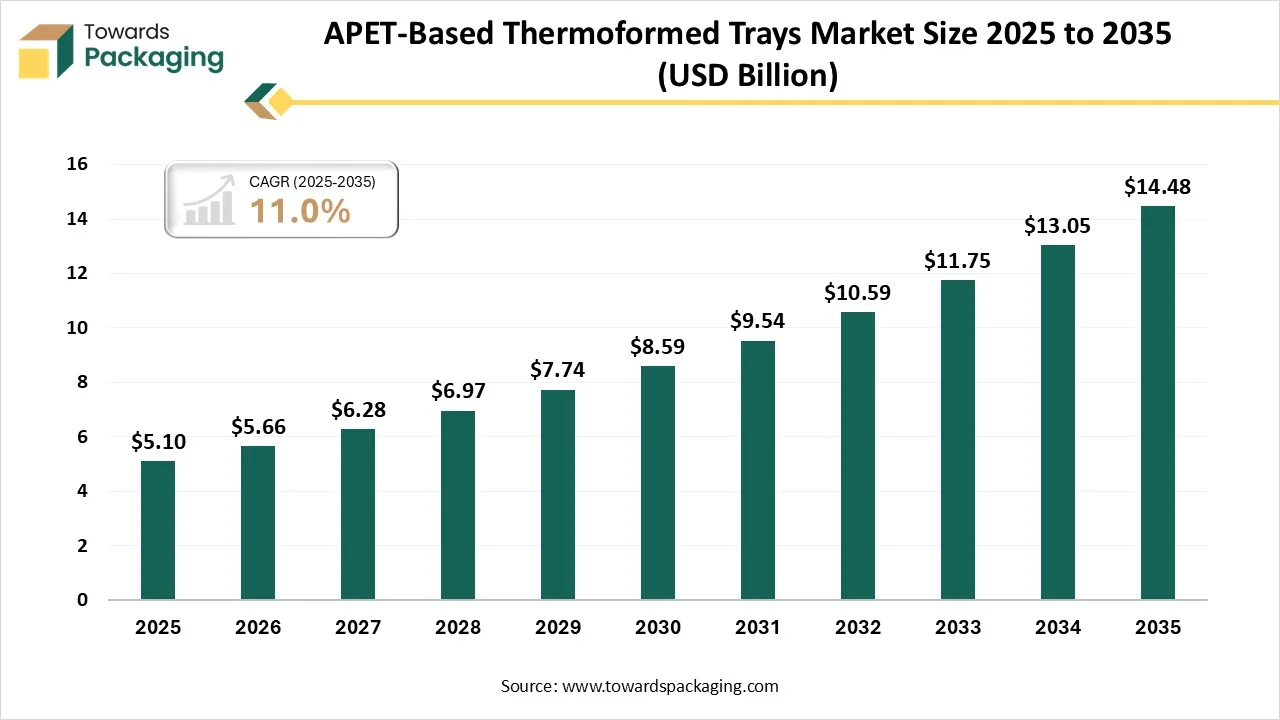

Sustainable Packaging Boom | $14.48B APET Tray Market Opportunity for Food & CPG Sellers

- Market grows 184% by 2035 (USD 5.1B to $14.48B); Asia-Pacific fastest growth; sellers must adopt eco-packaging to compete in ready-to-eat and food delivery categories

Overview

The global APET-based thermoformed trays market is experiencing explosive growth, expanding from USD 5.10 billion in 2025 to USD 14.48 billion by 2035—a 184% increase representing significant opportunities for cross-border e-commerce sellers in food, beverage, and consumer goods categories. This growth is driven by three converging forces: rising demand for ready-to-eat meals and food delivery (directly impacting Amazon Fresh, Instacart, and specialty food sellers), regulatory mandates for sustainable packaging (EU Single-Use Plastics Directive, California Extended Producer Responsibility laws), and consumer preference for transparent, recyclable packaging that enhances product visibility and brand perception.

For food and CPG sellers, this represents both a cost opportunity and a competitive necessity. APET trays offer superior clarity (critical for premium food presentation on e-commerce platforms), lightweight construction (reducing shipping costs 8-12% compared to rigid plastic alternatives), and recyclability (increasingly required by major retailers like Tesco, Whole Foods, and Amazon). Major industry consolidation signals market maturation: Toppan Holdings' USD 1.8 billion acquisition of Sonoco's thermoformed packaging business and Amcor's AmSecure launch indicate that packaging suppliers are racing to capture market share, which will drive competitive pricing for sellers sourcing sustainable packaging solutions.

Asia-Pacific represents the fastest-growing region, driven by rapid urbanization, rising disposable incomes, and explosive growth in organized retail and e-commerce sectors. This creates a critical advantage for sellers targeting Asian marketplaces (Alibaba, Lazada, Shopee): early adoption of APET packaging can differentiate products in crowded categories. Five market trends directly impact seller operations: (1) Sustainability innovation with recycled PET (rPET) content—sellers using 30-50% rPET can market products as eco-friendly, appealing to conscious consumers; (2) Smart functional packaging integrating QR codes and antimicrobial surfaces—enabling product authentication and traceability, reducing counterfeit risk; (3) Manufacturing automation reducing waste and cycle times—allowing smaller suppliers to compete on cost; (4) Lightweighting techniques lowering material usage and transportation emissions—directly reducing seller fulfillment costs; (5) Customization and premiumization—enabling brand differentiation through tailored designs that command 15-25% price premiums.

Immediate seller actions: Audit current packaging suppliers for APET compatibility and rPET content (target 30%+ by Q2 2025). For food sellers on Amazon, Instacart, and specialty platforms, switching to APET trays can reduce per-unit packaging costs by 5-8% while improving product presentation. Sellers in North America should prioritize suppliers with established recycling partnerships (Tesco's "tray-to-tray" initiative model), while Asia-Pacific sellers should source from manufacturers investing in automation to capture cost advantages. Long-term: consider vertical integration with packaging suppliers or exclusive partnerships to secure sustainable materials as regulatory requirements tighten globally.