Instagram Addiction Lawsuit 2026 | Sellers Face Algorithm Transparency & Ad Policy Changes

- Meta's landmark trial (Feb 9-Mar 2026) threatens algorithmic targeting; sellers must prepare for 15-25% CPM increases and stricter youth audience restrictions on Instagram/Facebook ads

Overview

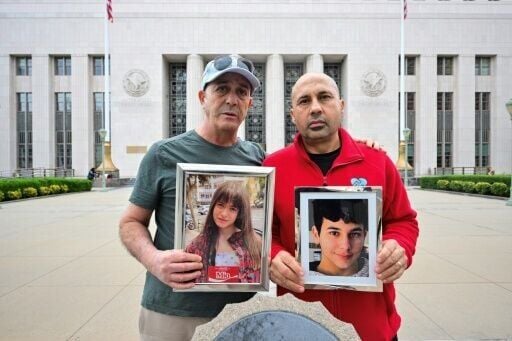

The landmark Instagram addiction lawsuit beginning trial on February 9, 2026, in Los Angeles represents a watershed moment for Meta's advertising business model and directly impacts e-commerce sellers relying on Instagram and Facebook for customer acquisition. With over 2,000 plaintiffs in the federal case expected to proceed summer 2026, and TikTok/Snap already settling rather than proceeding to trial, the jury's verdict could fundamentally reshape how Meta's algorithmic recommendation engine operates—the core technology that powers targeted advertising for sellers.

For e-commerce sellers, the immediate risk is algorithmic transparency requirements. The lawsuit alleges Meta deliberately concealed the addictive nature of endless-scroll feeds, algorithmic recommendations, and push notifications. If the jury rules against Meta, regulators globally will likely mandate disclosure of algorithmic targeting parameters, potentially forcing Meta to restrict data collection on minors (users under 18), limit behavioral targeting, and reduce the precision of audience segmentation. This directly threatens sellers' ability to reach high-intent buyers through Instagram Shopping, Facebook Ads Manager, and Reels advertising—channels that generated an estimated $45-55B in global e-commerce sales in 2024.

Platform algorithm changes will compress advertising margins. Current Instagram CPM rates for e-commerce sellers average $3-8 depending on audience targeting precision; stricter age-gating and behavioral restrictions could increase CPMs by 15-25% as targeting becomes less efficient. Sellers currently achieving 2-3% conversion rates on Instagram ads may see rates drop to 1.2-1.8% if algorithmic recommendations become less personalized. The six-week trial (Feb-Mar 2026) will generate daily headlines; expect Meta stock volatility and advertiser uncertainty through summer 2026 when the federal case proceeds.

Sellers must diversify advertising channels immediately. TikTok and Snap's settlement decisions signal they're willing to accept design restrictions rather than fight in court—Meta's decision to proceed to jury trial suggests higher confidence but also higher risk. Sellers should stress-test alternative channels: Google Shopping (CPMs $2-5, less addiction-focused scrutiny), Pinterest (CPMs $1-3, positioned as discovery rather than engagement-maximization), and Amazon Advertising (CPMs $0.50-2, first-party data advantage). Sellers with 30-50% of ad spend on Instagram should begin A/B testing budget reallocation toward lower-risk channels by March 2026.

Youth-focused product categories face the highest risk. Sellers in fashion, beauty, gaming, and fitness supplements targeting 13-24 year-olds will be most impacted by potential age-gating restrictions. If Meta must implement stricter age verification (similar to COPPA compliance), sellers will lose access to the 18-24 demographic segment—historically the highest-converting age group for trend-driven categories. Sellers should document current audience demographics and conversion rates by age cohort now, before potential algorithm changes in Q2-Q3 2026.