CVS Health Turnaround Signals Healthcare Retail Consolidation | Seller Opportunities in Pharmacy & Wellness E-Commerce

- $402.1B annual revenue (+7.8% YoY) drives pharmacy consolidation; 63 Rite Aid locations acquired; $20B 2026 headwinds reshape healthcare commerce landscape for B2B sellers

Overview

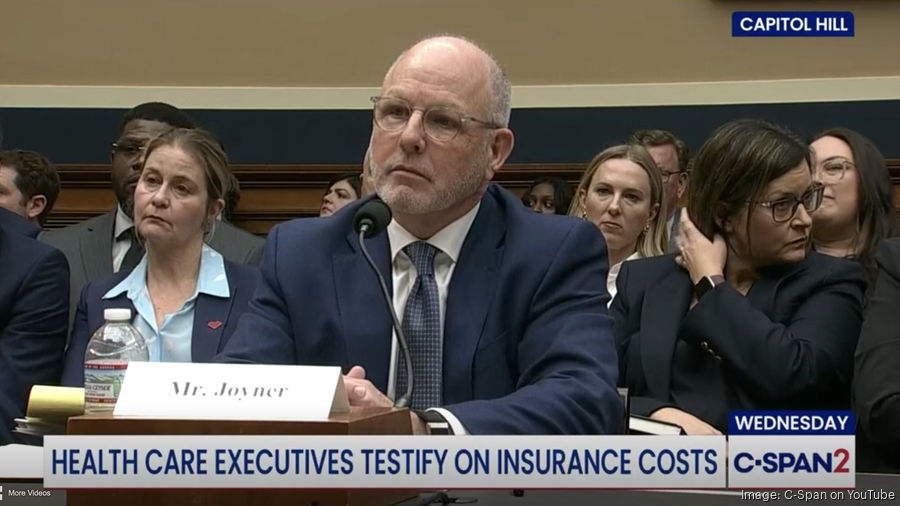

CVS Health's strong Q4 2025 performance ($105.69B revenue, +8.2% YoY) and reaffirmed 2026 guidance ($7.00-$7.20 EPS, $400B+ revenue) signals a critical inflection point in healthcare retail consolidation that directly impacts cross-border e-commerce sellers. The company's turnaround strategy—launched by CEO David Joyner in late 2024—demonstrates how major healthcare players are restructuring supply chains, pharmacy networks, and B2B procurement patterns. CVS's acquisition of 63 Rite Aid locations and 626 pharmacy prescription files, combined with 19% same-store sales growth and 10% prescription volume increases, indicates accelerating consolidation in the $1.2T+ U.S. pharmacy market.

For e-commerce sellers, this consolidation creates three distinct opportunities and risks. First, healthcare logistics and supply chain partnerships are expanding as CVS integrates acquired assets and invests in retail pharmacy technology. Sellers offering medical packaging, pharmaceutical-grade storage solutions, cold chain logistics, and healthcare compliance software can target CVS's 9,000+ pharmacies and Caremark's PBM operations. The company's $2B cost-cutting initiative signals demand for operational efficiency tools—inventory management systems, automated dispensing equipment, and supply chain optimization platforms that sellers can provide through B2B marketplaces like Amazon Business and specialized healthcare procurement platforms.

Second, consumer wellness product categories are experiencing tailwinds from CVS's expanded retail footprint and Medicare Advantage growth (10%+ YoY). The pharmacy and consumer wellness segment generated $37.66B in Q4 revenue (+12.4%), driven by higher prescription volumes and improved drug mix. This signals increased demand for complementary wellness products—vitamins, supplements, OTC medications, medical devices, and health monitoring equipment—that cross-border sellers can source from Asia-Pacific manufacturers and distribute through Amazon, Walmart Marketplace, and specialty health platforms. CVS's acceptance of TrumpRx discount cards and evolving direct-to-consumer healthcare models create new distribution channels for sellers offering price-competitive health products.

Third, economic uncertainty and consumer spending pressure present risks. CVS's $20B in 2026 headwinds—including $10B from ACA exchange market exit and $10B from lower drug prices following Trump's most-favored-nation agreements—indicate healthcare cost inflation will pressure consumer discretionary spending. The company's conservative guidance (midpoint $7.10 EPS vs. $7.17 analyst estimate) reflects broader healthcare sector volatility affecting corporate benefit plans and employee purchasing power. Sellers should monitor healthcare cost trends as indicators of consumer confidence and adjust inventory allocation toward essential health products rather than premium wellness categories.