Fed Chair Transition 2026 | Interest Rate Cuts & 15% Growth Projections Impact Cross-Border Seller Financing

- Kevin Warsh nomination signals aggressive rate-cutting policy; World Bank forecasts 1.9-2.2% growth vs. Trump's 15% projection creates market volatility risk for sellers with USD exposure and credit-dependent inventory financing

Overview

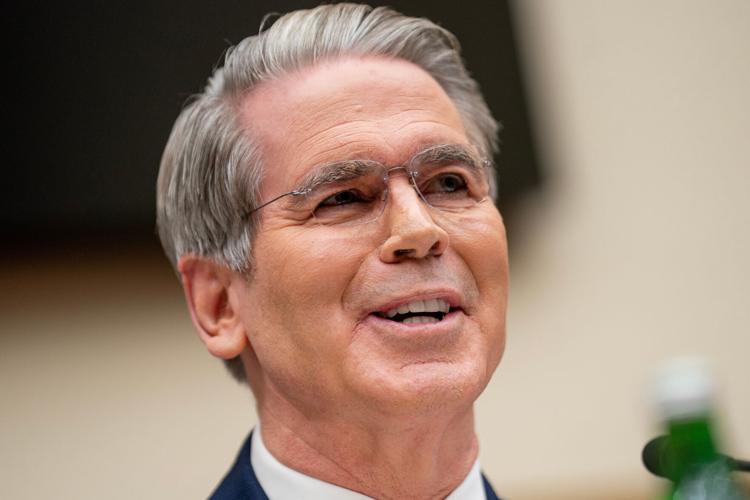

The Trump administration's nomination of Kevin Warsh as Federal Reserve Chair (replacing Jerome Powell in May 2026) represents a significant macroeconomic policy shift with direct implications for cross-border e-commerce sellers. Trump explicitly stated in February 2026 Fox Business interviews that Warsh could achieve 15% U.S. economic growth—a projection that dramatically exceeds World Bank forecasts of 1.9-2.2% growth and historical U.S. GDP averages of 2-3%. This policy direction signals a commitment to aggressive interest rate cuts, which Warsh has indicated he "understands" and supports, creating a fundamental divergence from Powell's inflation-focused approach.

For cross-border e-commerce sellers, this transition creates both opportunities and significant risks. The optimistic growth scenario would theoretically increase U.S. consumer purchasing power and demand for imported goods on Amazon, eBay, and Shopify, potentially benefiting sellers with inventory positioned for Q2-Q4 2026 demand surges. However, the stark gap between Trump's 15% projection and mainstream economic forecasts introduces substantial market uncertainty. If growth targets prove unrealistic, the Federal Reserve may reverse course with rate increases, triggering currency volatility and credit market tightening that could severely impact sellers relying on inventory financing, international payment processing, and USD-denominated working capital.

The confirmation process timeline is critical. Powell's term ends mid-May 2026, meaning Warsh's confirmation hearings will occur in Q1-Q2 2026. Senate Banking Committee chair Tim Scott and Republican Senator Thom Tillis have indicated they may block hearings pending resolution of a DOJ criminal investigation into Powell's Fed renovation spending—a politically motivated pressure campaign that creates additional uncertainty. This 6-12 week confirmation window coincides with peak Q1-Q2 seller planning periods, forcing sellers to make inventory and financing decisions amid policy ambiguity.

Currency and financing implications are substantial. A rate-cutting Fed typically weakens the U.S. dollar, benefiting sellers with significant USD exposure by improving export competitiveness. However, lower rates also increase borrowing costs for sellers using credit facilities denominated in other currencies (EUR, GBP, JPY), as currency spreads widen. Sellers with Amazon FBA inventory financed through credit lines should expect 50-150 basis point rate reductions if Warsh is confirmed, lowering borrowing costs but potentially increasing currency conversion losses on international transactions. Conversely, if growth projections fail and the Fed reverses course, sellers could face rapid rate increases and margin compression on existing debt.