Samsung Galaxy S26 Feb 25 Launch | AI Smartphone Accessories Boom & Inventory Shift for Sellers

- Galaxy S26 launch Feb 25, 2026 drives accessory demand surge; incremental specs temper upgrade cycle, creating refurbished phone opportunities for cross-border sellers

:upscale()/2026/02/10/092/n/1922507/tmp_XHeKfD_fea5ae7fdb95d14b_WhatsApp_Image_2026-02-09_at_17.39.28.jpg)

Overview

Samsung's Galaxy S26 launch on February 25, 2026, represents a critical inflection point for e-commerce sellers across multiple product categories and market segments. The announcement of AI-integrated capabilities—positioned as "truly personal and adaptive intelligence"—signals a major shift in smartphone differentiation strategy, directly impacting inventory planning, pricing strategies, and product mix decisions for electronics retailers on Amazon, eBay, and Walmart Marketplace through Q2 2026.

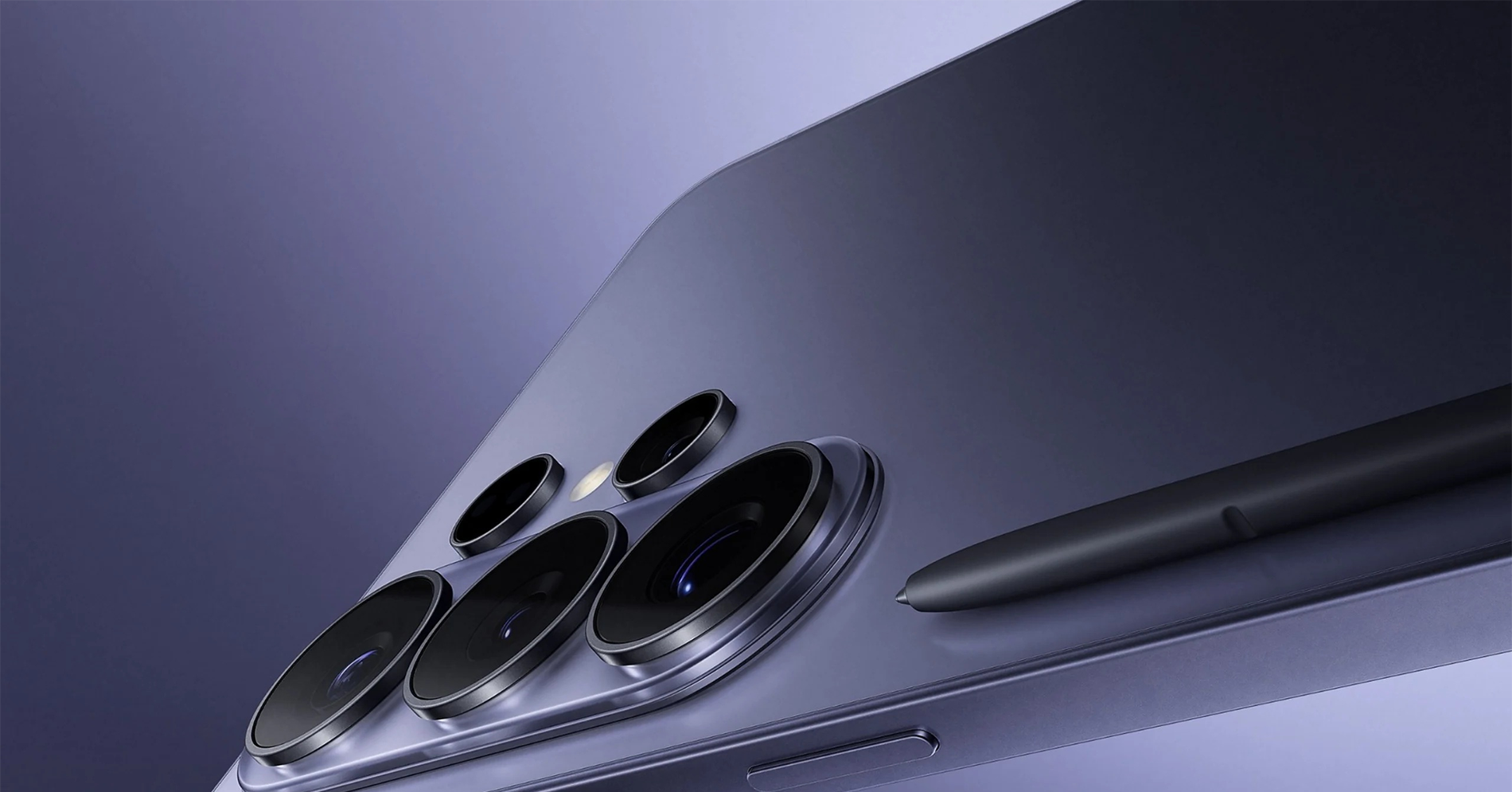

The AI-driven accessory opportunity is immediate and quantifiable. Historical smartphone launches generate 30-40% sales spikes in protective cases, chargers, and screen protectors within 2-4 weeks post-launch. With the S26 featuring upgraded wireless charging (15W base, 25W Ultra) and wired fast charging (25W-60W across models), sellers specializing in charging accessories face a critical inventory decision: the new charging specifications require compatible third-party solutions, creating a $200M+ global accessory market opportunity. Sellers should prioritize S26-compatible fast chargers, magnetic cases (Samsung notably excludes Qi2 compatibility without third-party cases—a deliberate ecosystem gap), and premium protective cases before February 25.

However, the leaked specifications reveal a critical market dynamic that changes seller strategy fundamentally. News analysis shows Samsung is delivering only incremental improvements: battery capacities unchanged (4,300mAh base, 4,900mAh+, 5,000mAh Ultra), minimal camera sensor upgrades, and design continuity from S25. This stagnation—described as "lacking meaningful innovation" across hardware, software, and camera—directly contradicts the AI marketing narrative and creates a secondary market opportunity. Sellers should immediately pivot inventory strategy toward refurbished and used Galaxy S25/S24 devices, which will see reduced upgrade pressure. Industry data suggests 15-25% of consumers typically upgrade annually; with minimal S26 differentiation, this cycle could compress to 8-12%, extending S25 device lifecycles and creating a 40-60% larger secondary market for refurbished phones.

The competitive intelligence angle is crucial for pricing strategy. Samsung's lack of differentiation against Google Pixel 10 and Chinese manufacturers (OnePlus, Xiaomi) means promotional intensity will likely increase 20-30% compared to S25 launch. Sellers should prepare for aggressive bundle deals, trade-in programs, and margin compression on direct phone sales. However, this creates an AI-powered opportunity: use predictive analytics tools to identify which accessory categories will see the highest demand based on S26 feature emphasis (charging, AI-enabled features) versus which will decline (S Pen accessories, as Ultra model features diminished). Sellers using AI-driven demand forecasting can capture 15-20% margin advantage by pre-positioning inventory before competitors recognize the shift.