AI Construction Tools Market Explodes | Seller Opportunity in B2B Tech & Smart Infrastructure

- $50B+ market through 2033 drives demand for software, hardware, safety equipment, and drone/robotics products across North America and Asia-Pacific regions

概览

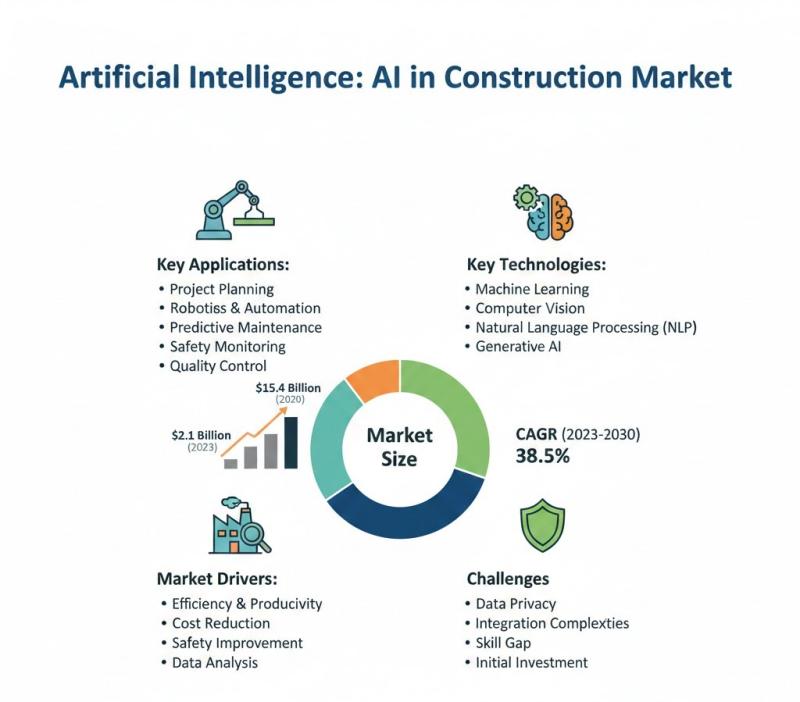

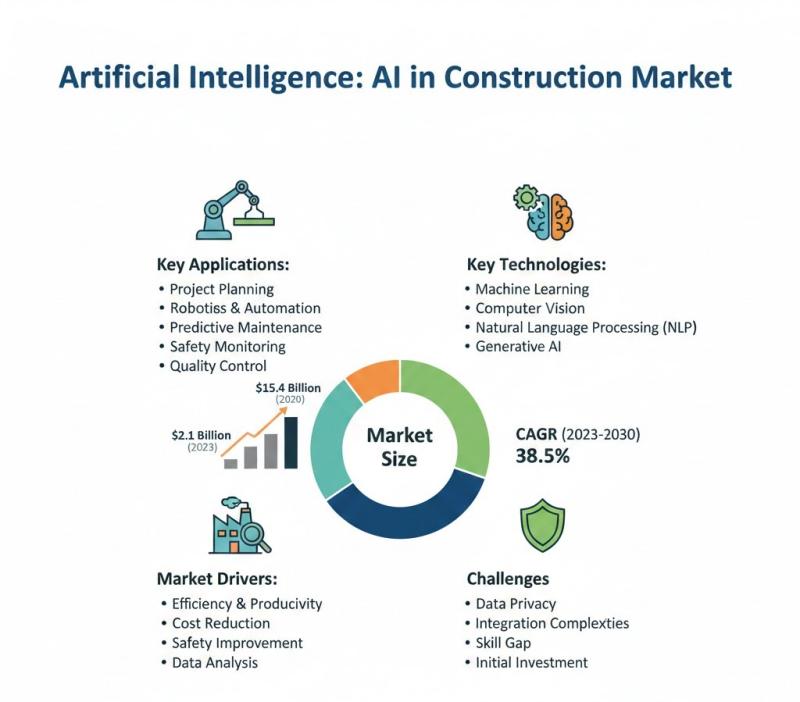

The global AI in Construction market is experiencing explosive growth through 2033, with HTF MI Research projecting significant expansion across project management tools, computer vision safety systems, and predictive analytics platforms. This represents a critical opportunity window for cross-border e-commerce sellers across multiple product categories and B2B segments.

Direct Seller Opportunities: The construction AI boom creates immediate demand for complementary products and services. Sellers can capitalize on several angles: (1) Hardware & Equipment - Safety vests with embedded sensors, hard hats with AR/computer vision integration, drones for site monitoring, and IoT sensors for predictive maintenance are experiencing accelerated adoption. (2) Software & Digital Products - Training courses, API integrations, and plugins for platforms like Procore, Autodesk, and Trimble represent high-margin digital product opportunities. (3) Safety & Compliance Products - Computer vision safety systems require supporting equipment, documentation tools, and compliance software. (4) Robotics & Automation Accessories - Construction robotics expansion drives demand for replacement parts, charging stations, and maintenance supplies.

Geographic Expansion Strategy: North America currently dominates the market, but Asia-Pacific represents the fastest-growing region. This signals a 12-18 month window for sellers to establish presence in Chinese, Indian, and Japanese construction tech markets before competition intensifies. Sellers should prioritize localization for these regions—translating product listings, adapting payment methods, and understanding regional construction standards (China's BIM mandates, India's infrastructure push, Japan's labor shortage solutions).

Market Drivers Creating Urgency: Labor shortages accelerating automation demand means construction companies are actively seeking solutions NOW, not in 2-3 years. This creates a 6-12 month window of elevated buyer willingness and budget availability. Rising requirements for project cost optimization and smart infrastructure development indicate B2B buyers are actively evaluating solutions. Mid-sized contractor adoption represents the sweet spot—large contractors have established vendor relationships, but mid-sized firms (100-500 employees) are actively shopping for solutions and represent 40-60% of the addressable market.

Competitive Intelligence: Key players (Autodesk, Trimble, Bentley Systems, Procore, IBM, Microsoft, Nvidia, Caterpillar) are consolidating the enterprise segment, but gaps exist in the mid-market and emerging markets. Sellers can differentiate by targeting underserved segments: small contractors (under 50 employees), regional construction firms, and emerging market players lacking access to premium solutions.

Risk Considerations: This is a B2B market with longer sales cycles (90-180 days), higher customer acquisition costs, and technical support requirements. Sellers must be prepared for detailed product specifications, compliance documentation, and potentially custom integrations. The market's focus on safety and cost optimization means liability and accuracy are paramount—poor product quality or inaccurate data could result in construction delays or safety incidents, creating legal exposure.