AI Vendor Risk Alert: $115B Loss Forecast Threatens E-Commerce Tools

- OpenAI's $11.5B Q3 2025 losses signal AI bubble peak; sellers must audit vendor stability before adopting AI-powered logistics, pricing, and customer service platforms

概览

The AI Bubble Warning Signals Critical Vendor Risk for E-Commerce Sellers

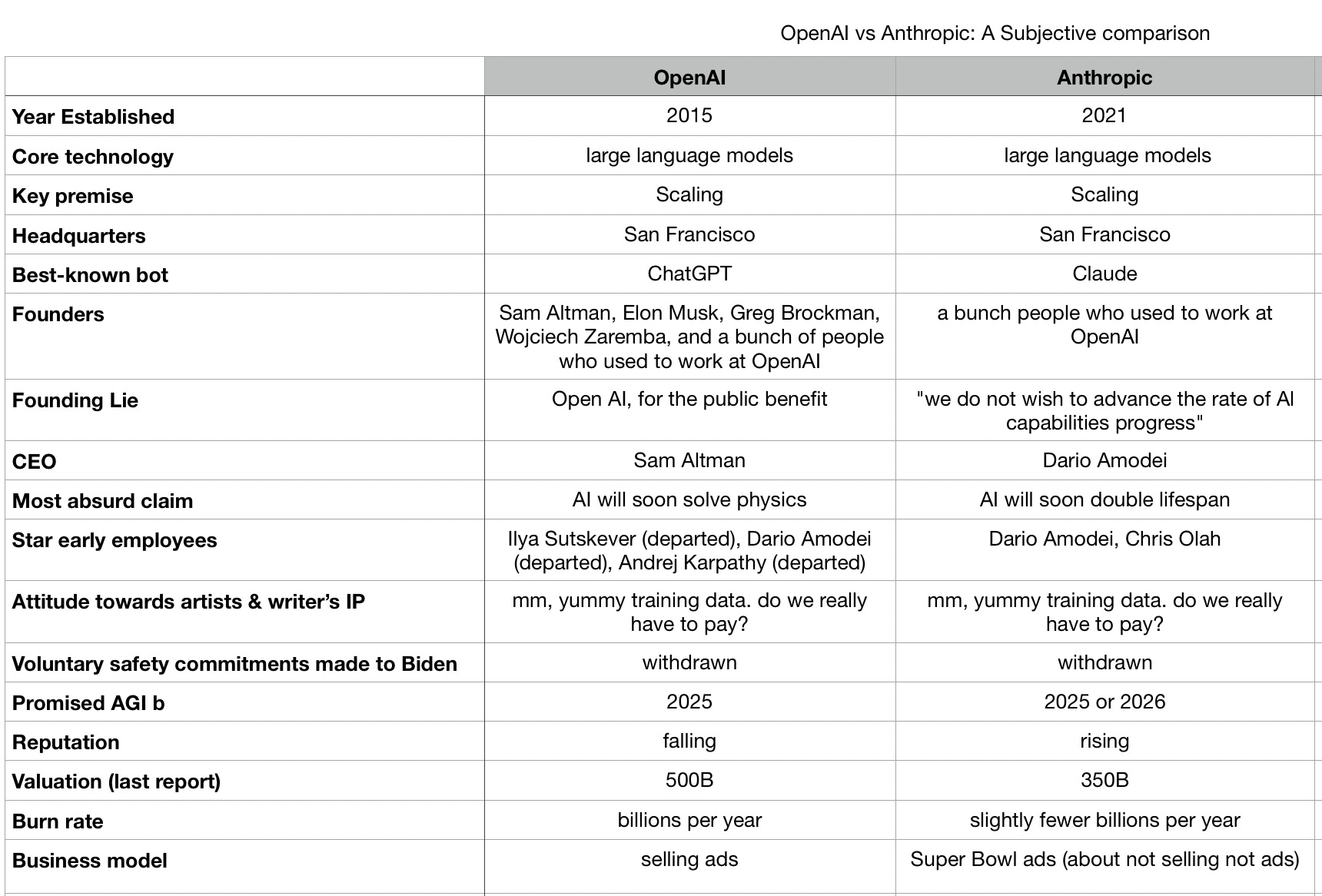

Published February 8, 2026, by MarketWatch economists Jeff Funk and Gary Smith, a major opinion piece draws direct parallels between current AI industry advertising (Super Bowl LX, 2026) and the dot-com crash precursor (Super Bowl XXXIV, 2000), when 14 of 61 ads promoted internet startups before the collapse. This historical pattern carries immediate implications for e-commerce sellers investing in AI-powered business tools.

The Financial Reality Behind AI Vendor Instability

The core issue: OpenAI lost $11.5 billion in Q3 2025 alone and forecasts $115 billion in cumulative losses by 2029—a trajectory far worse than Amazon's $3 billion cumulative losses over 10 years before 2004 profitability. Large language model (LLM) companies face a paradoxical business model where increased customer adoption accelerates losses because operational costs exceed customer willingness to pay. This creates existential risk for smaller AI vendors competing against well-capitalized players like Google's Gemini.

For e-commerce sellers, this matters directly: Sellers relying on AI-powered inventory management, dynamic pricing optimization, and customer service automation platforms face potential vendor collapse if funding dries up during a market correction. The Economist has published multiple warnings since September 2025, and Time magazine's 2025 "Person of the Year" selection of "Architects of AI" historically precedes stock declines in 7 of 8 previous instances—a contrarian indicator suggesting peak hype.

Immediate Operational Risks for Seller Segments

Small-to-medium sellers (SMBs) using third-party AI tools for product research, listing optimization, and customer service chatbots face the highest disruption risk. If vendors like Helium 10, Jungle Scout, or smaller AI-powered 3PL providers face funding cuts, sellers lose access to critical automation tools mid-season. Mid-market sellers with custom AI integrations for dynamic pricing or inventory forecasting need contingency plans if their vendor partners face acquisition or shutdown.

Strategic Vendor Evaluation Framework

Sellers should immediately audit AI tool vendors using profitability metrics rather than user growth. Prioritize vendors with: (1) Demonstrated profitability or clear path to positive unit economics, (2) Diversified revenue streams beyond LLM APIs, (3) Established customer bases with multi-year contracts, (4) Well-capitalized parent companies (Google, Amazon, Microsoft). Avoid speculative AI startups with venture funding as primary revenue source.

Competitive Intelligence Opportunity

Sellers who shift away from unprofitable AI vendors to proven, profitable alternatives gain competitive advantage. Established platforms like Amazon's native AI tools (Advertising Console, Demand Forecasting) or Shopify's built-in AI features offer stability. Sellers can reduce tool costs 20-40% by consolidating to platform-native AI rather than third-party SaaS, improving margins during potential market downturn.