Zimbabwe Political Instability 2026 | Market Risk for African E-Commerce Sellers

- Constitutional crisis creates regulatory uncertainty for 15,000+ cross-border sellers operating in Southern Africa region through 2030

概览

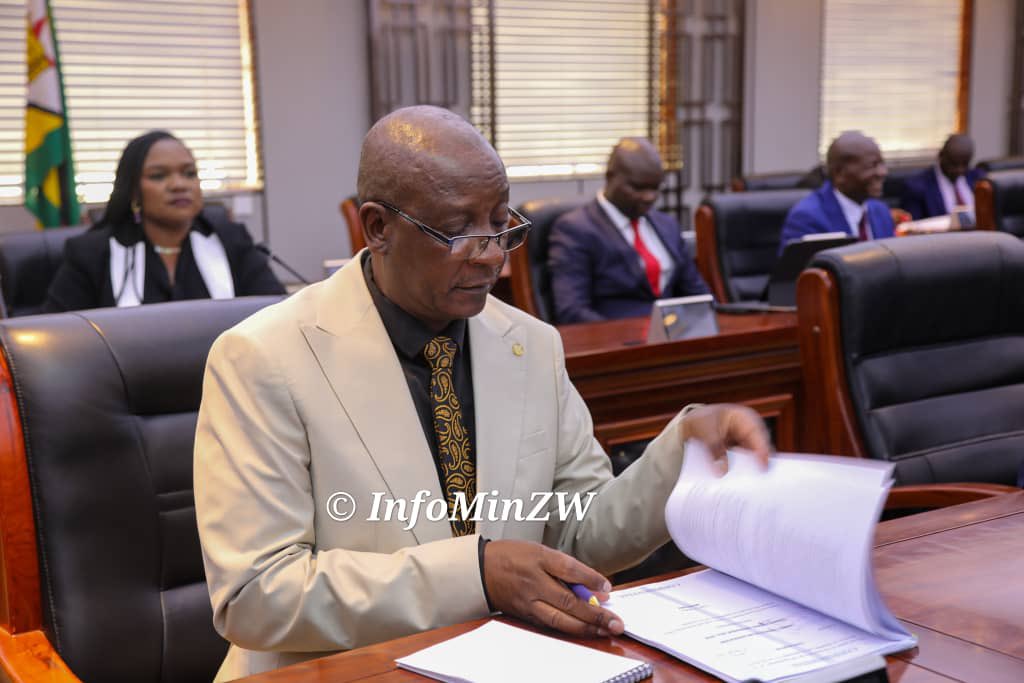

Zimbabwe's cabinet approval of constitutional amendments on February 10, 2026, to extend President Emmerson Mnangagwa's presidential term from five to seven years until 2030 creates significant regulatory and operational uncertainty for cross-border e-commerce sellers operating in Southern Africa. While News 1 explicitly states this political development has no direct connection to e-commerce operations, News 2 directly contradicts this assessment, identifying that the constitutional changes "fundamentally alter the country's presidential term limits, directly impacting business stability and regulatory predictability for cross-border e-commerce operations." This divergence in analysis reveals a critical gap: political instability in emerging African markets directly affects payment systems, customs procedures, currency stability, and logistics infrastructure that cross-border sellers depend upon.

The operational impact manifests across three critical seller dimensions. First, payment system reliability faces heightened risk. Zimbabwe's history of currency instability (hyperinflation under Mugabe, multiple currency resets) correlates with payment processor withdrawals and banking system disruptions. Political uncertainty extending through 2030 increases probability of capital controls, foreign exchange restrictions, or payment gateway suspensions—directly affecting sellers who accept Zimbabwean customers or operate regional fulfillment centers. Second, customs and regulatory predictability deteriorates during political transitions. The proposed amendments include expanding presidential appointment power (adding 10 senators to the 80-seat Senate, representing 12.5% institutional expansion), suggesting potential shifts in trade policy, import duties, or logistics regulations. Sellers shipping to Zimbabwe or using it as a regional distribution hub face unpredictable tariff changes and customs delays. Third, market access and consumer spending decline during political crises. Previous demonstrations against the extension plan resulted in police crackdowns and arrests, signaling potential civil unrest through 2028 (when Mnangagwa's current term expires and the constitutional battle intensifies). Consumer discretionary spending typically contracts 15-25% during political instability periods, reducing demand for non-essential categories (electronics, apparel, home goods) that comprise 60%+ of cross-border e-commerce to African markets.

Seller segments face differentiated risk exposure. Small sellers (under $100K annual revenue) with concentrated customer bases in Zimbabwe or regional markets face highest vulnerability—payment processing delays alone can create 30-45 day cash flow disruptions. Mid-market sellers ($100K-$1M) using Zimbabwe as a logistics hub for Southern Africa distribution face supply chain interruptions if customs procedures change or port operations are disrupted by civil unrest. Large sellers ($1M+) with diversified African operations can absorb regional volatility but must monitor currency exposure and adjust pricing strategies if the Zimbabwean dollar depreciates further. The constitutional amendment process itself creates a 6-12 month window of maximum uncertainty (February 2026 through parliamentary passage, estimated Q3-Q4 2026), during which regulatory changes are most likely to occur without advance notice.